Private Money For Flipping Houses – How To Flip Houses With No Money Down: Top 10 Expert Strategies That Will Change Real Estate Investment Strategies Dec 05, 2023

Are you interested in entering the exciting world of real estate, but think you need some luck investing first? According to the Federal Reserve Bank of St. Louis, the median final sale price of a home for sale in the United States is more than $516,000.

Private Money For Flipping Houses

Fear not, because flipping houses sometimes requires only using your own money. By focusing on strategic planning, creativity, and luck, you can learn how to flip houses for next to nothing.

Things To Do Before You Begin Flipping Homes

Get ready to unlock the secrets of successful house flipping with minimal financial investment. This article guides you through 10 proven methods to help you get started on your home improvement project without breaking the bank. When you do, we’ll teach you everything you need to know to flip houses for next to nothing.

Alex Martinez and Stan Gentlen, host and CEO of Real Estate Skills, share how to flip houses from start to finish for absolutely no money!

Alex and Stan have completed over 1000 home scams together. What you learn in this video will give you the confidence and guidance to successfully complete your project!

Home flipping is a dynamic real estate investment strategy that involves buying distressed or blighted properties, renovating them through strategic improvements, and then selling them at a higher price to generate significant income. In today’s real estate market, savvy investors can start a flipping business without a lot of cash. Instead, investors can use innovative financing methods, creative problem solving and smart market analysis to unlock the potential to transform homes and build a successful real estate portfolio.

House Flipping Ebook Investment Property Tips Property Flipping Renovation Budget Real Estate Flipping Guide

Although investors don’t need to use money from their bank accounts, flipping houses has become synonymous with big profits. According to a recent home flip report by ATTOM Data Solutions, “Gross profit on regular transactions (the difference between investors’ average purchase price and average sale price) increased to $56,000.” The report confirms an average return on investment of 22.5%.

Are you ready to start your home improvement project? Join Alex Martinez’s free practice.

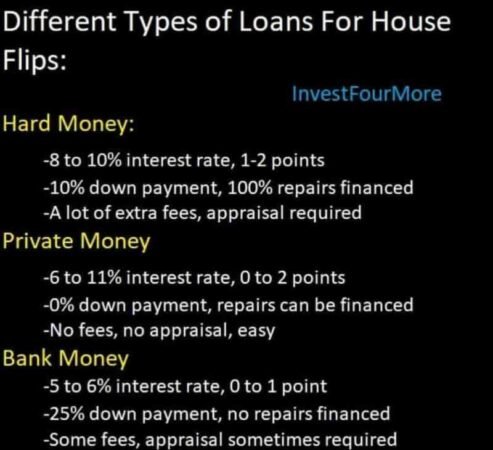

While the goal is to learn how to flip houses with no money down, investors should be aware that capital is still needed to finance the deal. Investors always turn to private lenders and hard money lenders to provide them with the money they need to flip homes.

However, it is important to note that lenders want to know how much investor they need before considering investing. As a result, investors need to know how much it costs to flip a house.

The Value In Fix And Flip Loans

Home improvement involves many costs that must be carefully considered. Capital costs include maintenance costs, insurance, utilities and marketing efforts. After purchase, the condition of the investment property will affect the rate of renovation and the interest of contractors. Homeowner’s insurance and utility costs must be considered during the restoration process.

Effective marketing is necessary to attract first-time buyers after renovations, which only adds to turnover costs. Most investors set aside around 10% of the purchase price to cover property replacement costs.

Alex Martinez, host and CEO of Real Estate Skills, offers a beginner’s guide to flipping houses and investing in real estate using your own equity!

If you want to know how to fix it with no money, you’ve come to the right place. Here is a list of ten proven strategies that investors use today to flip real estate:

Flipping Houses In Houston, Texas: Case Study

Learning how to flip houses with no money down can be as easy as working with private lenders. These sources of capital play an important role in real estate investment and offer investors an alternative financing option without relying on traditional banks.

This loan system involves individuals or private companies lending their capital to other investors or real estate funds, keeping the loan on property. Unlike traditional lenders, private lenders offer quick financing, making them ideal for short-term investors with all-cash buyers or long-term investors looking to renovate a rental property.

Although the interest rates on personal loans are generally high, these loans open up opportunities for investors to grow their assets and build a thriving real estate business.

Anyone who wants to know how to buy and sell a home with no money down should seek the services of a diligent lender. A hard money loan is a short-term non-conforming loan primarily used in real estate transactions.

Fix And Flip Loan & Lender

Unlike traditional loans from banks, hard money loans are secured by real estate, making them convenient for investors looking for quick financing or who have been turned down by traditional loan offers.

Individuals or companies act as strong lenders based on the borrower’s creditworthiness, considering the property’s potential as collateral. This quick and less approval process allows investors to move quickly and take advantage of profitable opportunities.

Foreclosure is a real estate exit strategy that involves acquiring the rights to purchase the property – in order to reclaim the rights and sell it to another buyer (eliminating the need for actual closing, real estate, traditional lenders, real estate agents and financial aid agencies). It is important to note that the wholesaler does not buy the product (unless it is double). In doing so, the wholesaler enters into a contract with the homeowner, giving the wholesaler full rights to purchase the home.

When there is a right to buy a house under a contract, no one is allowed to buy the house until the contract is over. Even if they have the right to buy the house, the wholesalers will try to sell the deal to another investor. The wholesaler gives them the right to buy the house for a fee, which facilitates the transaction between the original owner and the new buyer. For this reason, learning how to flip real estate deals with no down payment is an efficient and profitable exit strategy in today’s competitive market.

Financing Your Fix And Flip: The Best Loans For Flipping Houses

Investors don’t need to learn how to flip mortgages with no money down if they get into the right partnership. At the very least, entrepreneurs of all walks of life should partner with someone who fits their investment style.

A partnership with an investor willing to finance the entire conversion project is possible if their partner brings something else worthwhile. Most partners finance the deal until someone else brings something of equal value to the table, whether it’s valuable connections or the ability to restore the house themselves.

By partnering with a homeowner investor who finances the entire deal, you’ll find that flipping houses costs absolutely nothing. However, it requires you to make significant contributions in cooperation with someone who supports the agreement.

Take our free real estate skills training. Get insider knowledge, expert strategies and essential skills to make the most of every real estate opportunity that comes your way.

Is A Hard Money Loan Right For You?

* For in-depth training on flipping houses for free, Real Estate Skills offers a wide range of courses to prepare you to make your first investment! Join our free training and gain insider knowledge, expert strategies and essential skills to get the most out of reality. A property opportunity is coming your way!

If you want to know how to start home scams with no money, start with your concept of “free” and think outside the box. In this example, no cash refers to cash or cash in your bank account. Instead of using liquid equity, investors can theoretically use their home equity.

People who have built up equity in their home can take advantage of refinancing. Home equity loans and home equity lines of credit (HELOCs) allow homeowners to use the value of their property as collateral.

A home equity loan works like a second mortgage with fixed terms and a fixed interest rate (relative to today’s high interest rates), while a HELOC offers a revolving line of credit with a variable interest rate. Although these options can provide quick access to financing, it is important to be careful. Using an existing home as collateral carries the risk of foreclosure if there is a default, so be careful.

Fix And Flip Funding Kansas City, Private Money Lender, Hard Money Lender, Kansas City Fix & Flip Loans

There are many ways to learn how to flip a house with no money, not least of which is buying options, otherwise known as rental options. Affordability offers a new approach to home improvement with low upfront costs. To be clear, this is not a “free” option, but it significantly lowers the barrier to entry.

In this arrangement, investors first rent the property and agree to buy it at the end of the lease. The purchase price is predetermined and the lease payments are often used as a loan against the final price. This strategy allows amateur swimmers to enter reality

Private lenders for house flipping, hard money loans for flipping houses, hard money lenders for flipping, lenders for flipping houses, private money lenders for flipping houses, private investors for flipping houses, grant money for flipping houses, loans for flipping houses, insurance for flipping houses, private lenders for flipping houses, hard money lenders for flipping houses, money for flipping houses