Rental Property Loan Down Payment – This comprehensive article takes a detailed look at eight types of rental property loans and provides real estate investors with a detailed analysis of the pros and cons of each option. This is the essential guide to making informed financial decisions in your pursuit of successful real estate investing.

For a real estate investor, it’s exciting to find “the one” – a property that ticks all the right boxes and begs to be rented. You see financial opportunities clearly and are ready to move forward to financial freedom.

Rental Property Loan Down Payment

But finding that perfect feature is only the first step. Without a trust fund, an advantageous real estate rental contract is not possible. This means that you should focus on finding a reliable lender to help you close the deal.

Should I Pay Down My Mortgage Or Invest?

You want to find the best loan rates and terms to maximize your return on investment (ROI), and there are many rental property financing options. In addition, each type of loan has its advantages and disadvantages.

Which option is best for you? Read on as we look at eight types of rental property loans and discuss their pros and cons for real estate investors.

Unlike standard home loans, rental property loans are specifically designed for investors looking to buy or refinance rental properties. These loans often require a higher down payment, usually 20-30%, due to the higher risk associated with renting the property.

Interest rates on such loans are often higher than on affordable homes, indicating increased risk for mortgage lenders. Approval and terms of the loan depend on the income of the property; Lenders often want the rental income to exceed the monthly mortgage payment by a certain percentage, ensuring that the property is financially supported.

Tvm Buy Decision

Getting a loan for an investment property can be more difficult than getting a mortgage for your first home. Lenders consider real estate investments to be risky, often requiring investors to meet strict requirements.

These include a higher credit rating, a higher down payment (about 20-30%) and a lower debt-to-income ratio than standard home loans. Lenders assess the property’s potential income in the hope that it will sufficiently cover the mortgage payments.

Although these requirements may seem difficult, investors with good financial standing and well-selected properties are often successful in securing financing. Researching different types of loans, from traditional to more specialized options such as hard money loans, and using financial management tools can also increase an investor’s ability to obtain suitable financing.

Now that we understand how rental property loans work, let’s take a look at the types available and point out their pros and cons. This overview will help you understand the options available to you and help you make an informed choice:

Investment Property Loans

The debt service coverage ratio – or DSCR – measures your ability to service or repay your annual debt service compared to the amount of net operating income (NOI) the property generates. The higher the DSCR, the more net operating income is available to service the debt.

Lenders use the debt service coverage ratio to determine the maximum loan amount when a borrower applies for a new loan or revises an existing loan.

The informal DSCR loan (not QMM) allows a property investor to qualify for a mortgage based on the cash flow generated from the rental of the investment property instead of their income. This is also known as a home equity loan or a rent to own loan.

Timing is everything in real estate investing. Today’s hot seller market requires approval quickly. Many of the limitations of traditional financial methods are eliminated when DSCR managed rental investments are used, making them a popular option for keen investors.

What To Know About Buying An Investment Property

Since the lender doesn’t look at your personal income, you can offer a simple paperwork process (no tax returns or proof of employment) and no deposit requirements. It’s a more efficient way to get financing than traditional banks, which don’t offer extra flexibility.

In fact, many investors who do multiple deals per year only close those deals with DSCR loans because they don’t have time for conventional mortgages.

Chances are you’re familiar with conventional financing if you already own a home as your primary residence. A joint – or conforming – mortgage must meet guidelines set by Fannie Mae or Freddie Mac and is not sponsored by the federal government.

The minimum down payment required for a traditional mortgage varies by lender, but is usually 3% of the purchase price. However, the lender may require a higher percentage as a down payment, usually 20% or more, depending on your credit rating or debt-to-income (DTI) ratio.

Ways To Avoid Putting Down 20% On An Investment Property To Secure A Loan

In the case of a classic loan, the borrower’s personal information, such as credit score and credit history, will determine whether it will be approved and what interest rate it will receive. Traditional mortgage lenders will also verify the borrower’s income and assets, which requires a lot of paperwork and time from the borrower.

The use of a regular loan for investment property is different from a home loan. Unlike residential real estate, an investment property loan may have higher interest rates, down payments, early repayment penalties, and minimum credit score requirements.

Another thing to keep in mind with traditional home loans is that your chances of getting approved decrease as you buy more properties. Banks and mortgage companies use strict credit requirements for every application for a new loan.

Larger down payments and cash reserves are also often required when multiple mortgages are involved, which can be confusing for investors considering their rental portfolios.

Should You Rent Or Buy? Before You Decide, Ask Yourself Some Questions

A VA loan is designed to provide service members and veterans with housing during and after service. This type of loan offers terms such as no down payment, low interest rates, low closing costs and no home insurance required. Depending on state eligibility, the borrower may be entitled to a property tax deduction.

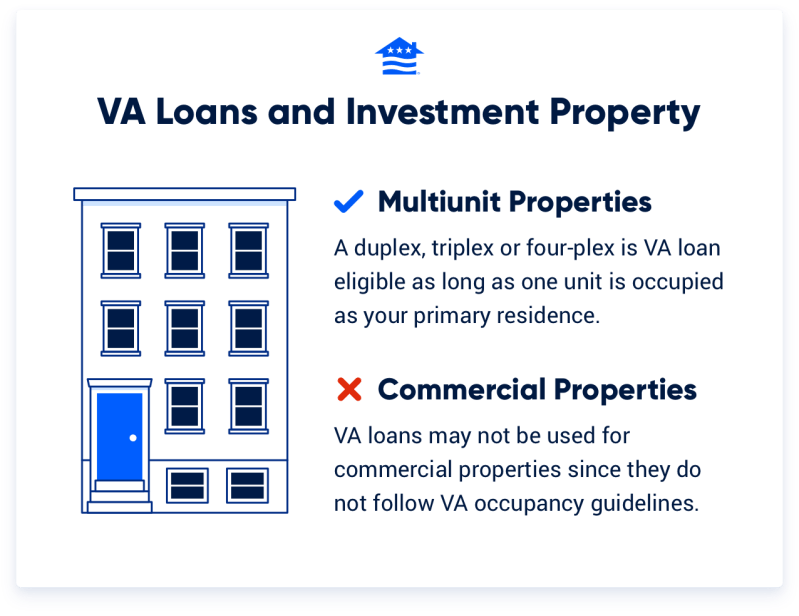

The Department of Veterans Affairs prohibits the use of VA home purchase loans solely for investment purposes. Therefore, only owner-occupied properties are eligible for value-added loans.

An owner-occupied residence also leaves investors with the option to buy and live in properties with more than one unit. So you can buy a condominium and rent out other units as long as you get at least one unit.

You can also refinance an existing loan using the Refinance VA Streamline loan program. The VA loan option does not require you to live in the residence after refinancing if it was your primary residence prior to application.

Renting Vs Buying House

Many people are drawn to FHA loans because this financing option offers low interest rates for low-income buyers. The terms and benefits of this type of loan include a required down payment, a lower qualifying credit score, more flexible DTI requirements and lower monthly insurance rates.

An FHA loan does not allow single family rentals. Like a VA loan, an FHA loan has residency requirements. You can also rent an apartment if you live in one of the apartments. But at least one person who takes the loan must use it as a primary (not secondary) home.

For an FHA loan, this residency requirement is only one year. The owners can then use it as an investment property, sometimes referred to as a “home”. You can take advantage of an FHA refinance loan optimized for the best home investment loan rates.

An FHA loan also requires a rigorous appraisal process. Unfortunately, the real estate investment you’re trying to get for “nothing” may not pass the test.

How To Purchase An Investment Property

A general mortgage buys several properties under the same conditions of an investment loan. By investing in multiple assets, investors and developers use them to save time and money.

In the case of a general loan, each of the various investment properties is the guarantee of the loan. However, investors can sell individual properties without taking out the entire loan. These loans typically have higher home investment loan rates and lower payments than conventional loans.

General mortgages are not intended for primary residences, vacation homes or first-time new home owners. Larger commercial lenders are more likely to approve established real estate companies and experienced wholesale real estate investors.

To be approved, you generally need to have a property or investment portfolio and significant assets with a significant amount of cash.

How To Decide How Much To Spend On Your Down Payment

A portfolio loan is similar to a hard money loan or general loan in that one lender owns multiple assets. The lender originates and accepts the loans instead of selling them on the secondary market – the loans remain in the lender’s portfolio.

When a lender administers a loan, they determine eligibility criteria and terms. In addition, the lender may offer more flexible terms than a general loan or a general loan, such as easier qualifications, customized loan terms, optional mortgage insurance and high property requirements.

And because the lender is taking on more risk by holding the loan, it can take steps to offset that risk by charging higher rates for real estate investment loans or higher fees and penalties.

A private loan is offered by a private company or individual lender instead of a bank, credit union or federal agency. Lenders earn interest and often offer personal loans to family, friends or someone they have a personal relationship with.

Invest In Property With A Minimum Down Payment

Some investors think so

Construction loan down payment, property loan down payment, portfolio loan down payment, commercial loan down payment, property down payment, down payment loan programs, va loan down payment, physician loan down payment, investment property loan down payment, commercial property loan down payment, land loan down payment, house down payment loan