Retained Earnings Formula Balance Sheet – Withheld salary. While the term may conjure up images of a group of suits gathered around a large table talking about stock prices, it actually refers to small business owners.

In human terms, retained earnings is the portion of profits that is earmarked for reinvestment in your business. In more practical terms, retained earnings is the income your company has earned to date, minus any dividends or other distributions paid to investors. Even if you don’t have investors, this is a valuable tool for understanding your business.

Retained Earnings Formula Balance Sheet

So why should you care about salary retention? And why should you, as a busy business owner, spend time calculating?

How To Find A Balance Sheet Error

Next: Let’s look at where to find the right numbers and how to actually calculate retained earnings.

Now that we understand what retained earnings are and why they’re important, let’s get down to the math. To calculate your retained earnings, you’ll need three key pieces of information.

Retained earnings are calculated to date, meaning they are accumulated from one period to the next. So, to start calculating your current salary, you need to know what it was at the beginning of the time period you’re calculating (usually the previous quarter or year). You can find the retained earnings on your balance sheet for the previous period.

It’s basically a fancy term for “profit”. This is the total income that is left over after deducting your business expenses from your total income or sales. You can find it on your income statement.

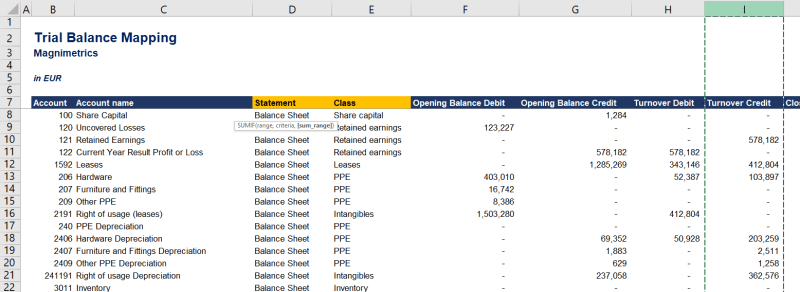

Trial Balance Mapping For Financial Reports

If your business currently pays dividends to shareholders, you must subtract the total amount paid from your previous retained earnings balance. If you don’t pay dividends, you can ignore this part and replace that part of the retained earnings formula with $0.

Do you have all the numbers you need? Time to get out the calculator. The basic formula for calculating retained earnings is:

As you can see, once you have all the data you need, it’s a very simple calculation – no triangle class flashback required.

Let’s look at a real example of our formula. Malia owns a small bookstore and wants to attract an investor to help expand the store to multiple locations. An investor wants to know how their earnings are today.

Free Printable Balance Sheet Template [track Finances] + Pdf / Word

Here is another example. Herbert owns Meowbots, a startup that sells robotic cats, and is looking to hire new developers. Before he can hire new employees, Herbert needs to know how much money he has to invest.

Since MeowBots has $95,000 in retained earnings to date, Herbert should not hire more than one developer.

Revenue is the income that comes from the sale of goods or services in your business. It represents the total capital that the business generates in the form of gross sales. It does not take into account costs, expenses or profits.

Good question! If you did the math with us during the example above, you now know what your retained income is. But what does this number mean? Knowing financial amounts is only important if you know what they are.

Solved Hi, I’m Not Sure Why I Am Getting Retained Earnings

Retained earnings are usually estimated based on the ratio of the company’s total assets. An ideal ratio of retained earnings to total assets is 1:1 (or 100 percent). However, this ratio is unrealistic for most real businesses, so don’t worry if you’re not there.

The truth is that retained earnings numbers vary from company to company – there’s no one-size-fits-all number you can aim for. However, a realistic goal is to get your ratio close to 100 percent, given your industry average. From there, you just look to improve the retained earnings periodically.

Send invoices, receive payments, track expenses, pay your team and balance your books with our free financial management software.

While understanding your retained earnings is important for business owners and a necessity in many situations, it has its drawbacks.

Solved] 1) Forecast Legends’ Next Years’ Income Statement And Balance…

If done every quarter gives a skewed perspective. If your business is seasonal, such as lawn care or snow removal, your retained earnings may vary significantly from quarter to quarter. Therefore, the calculation may not give a complete picture of your finances.

. Too much retained earnings can indicate that your business is not spending money efficiently or investing enough in growth, so frequent bank reconciliations are important. Lack of reinvestment and reserve costs can also be red flags for investors.

However, tracking your retained earnings is an important part of identifying such problems so you can fix them. Remember to interpret your retained earnings in the context of your business reality (such as weather conditions) and you’ll be in a good position to increase your profits and grow your business.

Still paying for bookkeeping or doing calculations by hand? Wave Accounting is free and built for small business owners, so it’s easy to manage the accounting you’ll need to calculate your earnings and more. There are no long-term commitments or trial periods – just powerful, easy-to-use software that customers love.

Why Must Financial Information Be Adjusted Prior To The Production Of Financial Statements?

The information and tips shared in this blog are intended to be used as learning and personal development tools in starting, running and growing your business. While these articles are a good start, they should not replace personal advice from professionals. As our lawyers would say: “All content on the Wave Blog is for informational purposes only. It should not be construed as legal or financial advice.” In addition, all content on the Wave Blog is legally copyrighted and may not be reused or published without our written permission.

Insights by Wave: Get paid faster with automated payments. Let’s dive into our research, show you how to set up automatic payments, and give you some tips to help you get paid faster!

What is an income statement? The income statement is about financial health. It shows the company’s income and expenses over a period of time. But it doesn’t work alone…

How to File Small Business Taxes in 4 Easy Steps While tax season isn’t a walk in the park, it doesn’t have to destroy your business. Here’s a quick overview of four things you’ll need to do when filing your small business taxes. Retained earnings is the company’s total net income or earnings after paying dividends. An important concept in accounting, the word “retained” reflects the fact that since these earnings were not paid out to shareholders as dividends, they were retained by the company.

How To Calculate Retained Earnings

For this reason, retained earnings decrease when the company either loses money or pays dividends, and increases when new income is generated.

What is the formula and calculation of retained earnings? RE = BP + net profit (or loss) − C − S Where: BP = initial period C = cash dividend S = stock dividend begin &text = text + text – text – text \ & textbf \ &text = text \ &text = text \ &text = text \ end RE = BP + Net Profit (or Loss) − C − S Where: BP = Beginning PeriodRE C = Cash Dividend S = Stock Dividend

Retained earnings refers to the historical earnings a company has earned, minus any dividends it has paid in the past. To better understand what your earnings can tell you, these options broadly cover all the possible ways a company can use excess cash. For example, the first option leads to the fact that the money earned will leave the accounting and accounts of the company forever, since the dividend payment is irreversible.

All other options retain earnings for use in the business, and these investing and financing activities constitute retained earnings.

How Balance Sheet Structure & Content Reveal Financial Position

Also called surplus income, these are cash reserves available for company management to reinvest in the business. When expressed as a percentage of total earnings, it is also called the retention ratio and is equal to (1 dividend payout ratio).

While this last option also takes money away from the business, it still affects the business accounts (for example, storing future interest payments, which are eligible to be included in retained earnings). ).

Profits leave plenty of room for the business owner(s) or company to use the extra money earned to manage it. These dividends are often paid out to shareholders, but can also be reinvested in the company for growth. Amounts not paid to shareholders are treated as retained earnings.

The decision to retain profits or distribute them to shareholders usually rests with the company’s management. However, this can be challenged by most shareholders as they are the real owners of the company.

Trend Analysis Of Financial Statements

Management and shareholders want a company to maintain earnings for many different reasons. Being better informed about the market and the company’s business, management may have a fast-growing project in mind that they can see as a candidate to fetch significant profits in the future.

In the long run, these measures may lead to better returns for the company’s shareholders than those obtained by paying dividends. High interest loan payments can also be very high.