Retained Earnings In Financial Statements – 09-03-2020 00:00:00 07-31-2023 00:00:00 https:///ca/resources/accounting/what-are-retained-earnings/ accounting Finland Retained earnings are defined as net profits accumulated in service a company managed by that company at a certain time. https:///oidam/intuit/sbseg/en_ca/blog/images/sbseg-retained-earnings.jpeg https://https:///ca/resources/accounting/what-are-retained-earnings/ What is Retained Income? | Canadian blog

Retained earnings are an integral part of any business. Without this, many companies would have to borrow a lot of money from banks or undertake an IPO. If you are starting a company and need information about accumulated profits, we offer help.

Retained Earnings In Financial Statements

At the end of the financial year, the company’s remaining net profit after dividends are distributed to owners (individual entrepreneurs or companies) or shareholders (in a partnership) is called retained earnings.

What Are Retained Earnings? How To Calculate Retained Earnings?

As the name suggests, it is the profit remaining for the company after all other profits have been distributed to their proper places. Retained earnings are part of equity or owner’s equity and are classified as such.

The purpose of this return is to reinvest the money to pay off the company’s additional assets and continue its operations and growth. Therefore, companies do not use the profit funds they collect, but for funds and activities that advance the business.

Companies calculate retained earnings at the end of each financial period – usually monthly, quarterly and annually. The formula is as follows:

This accounting formula takes the previous period’s retained earnings plus the company’s net profit, minus all dividends paid to owners and shareholders, to calculate the current period’s results.

Retained Earnings In Accounting And What They Can Tell You

Net income and retained earnings are not the same thing. However, net profit, net loss and dividends have a direct effect on retained earnings. Net profit is a company’s total income after taxes and expenses.

Companies are taxed on their net profits. Retained earnings is the amount a company receives after taxes on its net income. Thus, accumulated income is not subject to tax because the amount has been taxed as income.

Dividends refer to the distribution of money by a company to its shareholders. Many companies publish their dividend policies so interested investors can understand how shareholders are paid.

Dividends are usually paid to shareholders in cash – to be successful, a company first needs enough cash and a high enough profit margin. In other cases, the company may decide to distribute more shares of the company as dividends. These are called stock dividends because they issue common shares to existing common shareholders.

Measuring Income To Assess Performance

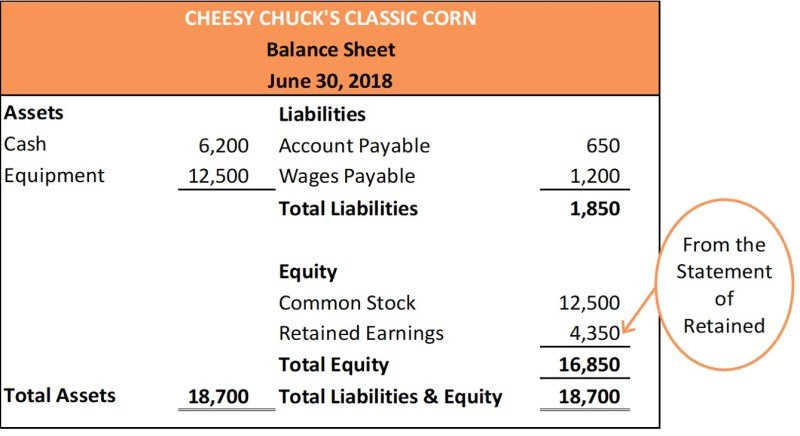

Retained earnings can be found on the right side of the balance sheet, along with liabilities and equity. See an example of a balance sheet below.

The balance sheet is a temporary view that describes the company’s current financial condition. At the end of the accounting period, an income statement is first prepared, after which the company can decide where the money and profits will be distributed.

Depending on the company management, they prepare a separate retained earnings statement or sometimes a combined income statement. The retained earnings account shows what happens to the retained earnings account. It reflects the accumulation of profits and the distribution of those profits to owners or shareholders.

This statement is an important indicator of the company’s overall financial condition. A large carrying value usually indicates that the company’s financial condition is good, while a negative value in the long term can be a sign of financial difficulties. It also shows all dividends distributed to shareholders for the financial year – cash and shares.

Statement Of Retained Earnings Gaap Vs Ifrs: Differences And Similarities

The amount of accumulated profits for the initial period is required when calculating the results for the financial period in question. You can find this information on your company’s balance sheet.

To calculate the growth in retained earnings for a company, you must first divide the retained earnings in a given fiscal period by the initial earnings in the same period. Then multiply that number by 100 to find out the percentage increase in your income during that period.

With the availability of professional accounting software, retained earnings can be calculated automatically, ensuring fewer errors and an accurate picture of your company’s financial position. With the reporting function, companies can easily view and understand their finances with the balance sheet summary and reporting features available. Try it for free today!

Intuit, QB, TurboTax, Profile and Mint are registered trademarks of Intuit Inc. Terms, features, support, pricing and service options are subject to change without notice. Running a business is not just about ideas, plans, strategies or tactics, but also dealing with numbers. Before starting a business, you should get basic knowledge about financial indicators.

Other Comprehensive Income, Oci, Aoci: The Basics, With 10 K Examples

One of the most important financial indicators of the efficient operation of an enterprise is accumulated profits. In today’s article, we will give you the meaning, calculation and implications of retained earnings.

Simply put, retained earnings are cumulative profits after the company pays all costs and distributions to its investors. This portion of a company’s net profit is often used to reinvest in the business itself. Retained earnings are also called retained earnings or retained earnings.

By definition, a company has shareholders who partially own the company by investing their money in it. These shareholders demand a share of the company’s net profits, paid in the form of shares or cash dividends.

Usually, when a company obtains positive results (profits), company management has several options to spend that amount. Often they pay these profits as dividends to shareholders. But they can also choose to keep the surplus and reinvest it into the business for growth purposes.

Solved: Preparing An Income Statement, Statement Of Retained Earnings, And Balance Sheet And Interpreting The Financial Statements [lo 1 2, Lo 1 3] [the Following Information Applies To The Questions Displayed Below.] Assume You

After dividends are paid to investors, the remaining net profit is considered the accumulated profit for the financial year. This amount is then added to the previous period’s retained earnings.

The purpose of these income cuts varies from company to company. Some companies use this money to purchase new equipment and machinery. Others spend money on research and development. The general goal is to earn more income in the future.

When and how a company uses this money depends on its financial situation. In some cases, it’s best to wait a few quarters or even a year.

The amount of accumulated profit is not static. Frequently adapt to changes in company operations and strategy. If the company experiences a net loss, then retained earnings can be converted into accumulated losses or accumulated losses.

Financial Statement Templates: Everything You Need To Know

In addition, if the company anticipates that the company will not be able to obtain sufficient returns on investment, then the company decides to distribute these profits to shareholders.

In terms of financial statements, the amount of retained earnings can be seen on the company’s balance sheet under the heading equity, equity. They are reported for each financial period, which is usually monthly, quarterly, and annually. Some companies also record retained earnings on their income statement.

Because retained earnings are an important indicator of financial performance in relation to the economic value generated over time, companies also prepare retained earnings calculations. This report shows changes in the amount of retained earnings during a certain accounting period.

After reviewing retained earnings, we want to dig deeper into this term by briefly comparing it to other financial definitions.

Problem 01: Corporations: Dividends, Retained Earnings, And Income Reporting

Earnings and retained earnings are similar but not identical. Current provisions are included in retained earnings.

Reserves are the portion of net income that is retained before dividends are paid; Retained earnings remain after paying dividends.

Companies hold reserves to strengthen the financial position of the business and cover possible future losses.

Turnover is actually the highest figure that shows a company’s financial performance. In retail sales, turnover is also called gross sales. However, revenue has a broader meaning because it calculates total income not only from sales but also from all operations.

How To Calculate Retained Earnings (for Smbs)

Turnover is calculated before operational costs. Retained earnings are part of the income stream, but retained earnings occur after all costs and profits have been paid.

Net profit is a result used to describe the financial performance of an organization. This is revenue minus all operating costs, salaries, taxes, etc.

Retained earnings and net profit are very closely related. Changes in net profit have a direct effect on the retained earnings balance.

Dividends are part of a company’s profits that are paid regularly to shareholders. Dividends can be in the form of cash or shares. Retained earnings is the amount of net profit minus dividends.

Statement Of Stockholders’ Equity, Earnings Per Share

Both forms of dividends reduce the retained earnings balance. Cash dividends are cash flows that reduce assets on a company’s balance sheet. Stock dividends direct a portion of accumulated earnings into common stock, which reduces the stock value per share.

In general, retained earnings can be negative. When a business experiences a loss, the net loss is recorded in the retained earnings statement. When net losses exceed past retained earnings, retained earnings become negative. In this case, the company experiences an accumulated deficit.

Even profitable companies can report negative retained earnings. Then the company pays out more dividends than is available

Retained earnings in accounting, retained earnings in balance sheet, where to find retained earnings on financial statements, financial statements in excel, notes in financial statements, retained earnings statements, inventory in financial statements, financial statements in accounting, ratios in financial statements, disclosures in financial statements, retained earnings financial statements, financial statements in quickbooks