Setting Up An Llc Bank Account – How can I get paid by my LLC? Corporate Tax Tips for Best Business Practices December 10, 2022

If you have partners in your LLC, this article does not exist. We have a separate feature for affiliate payment partners.

Setting Up An Llc Bank Account

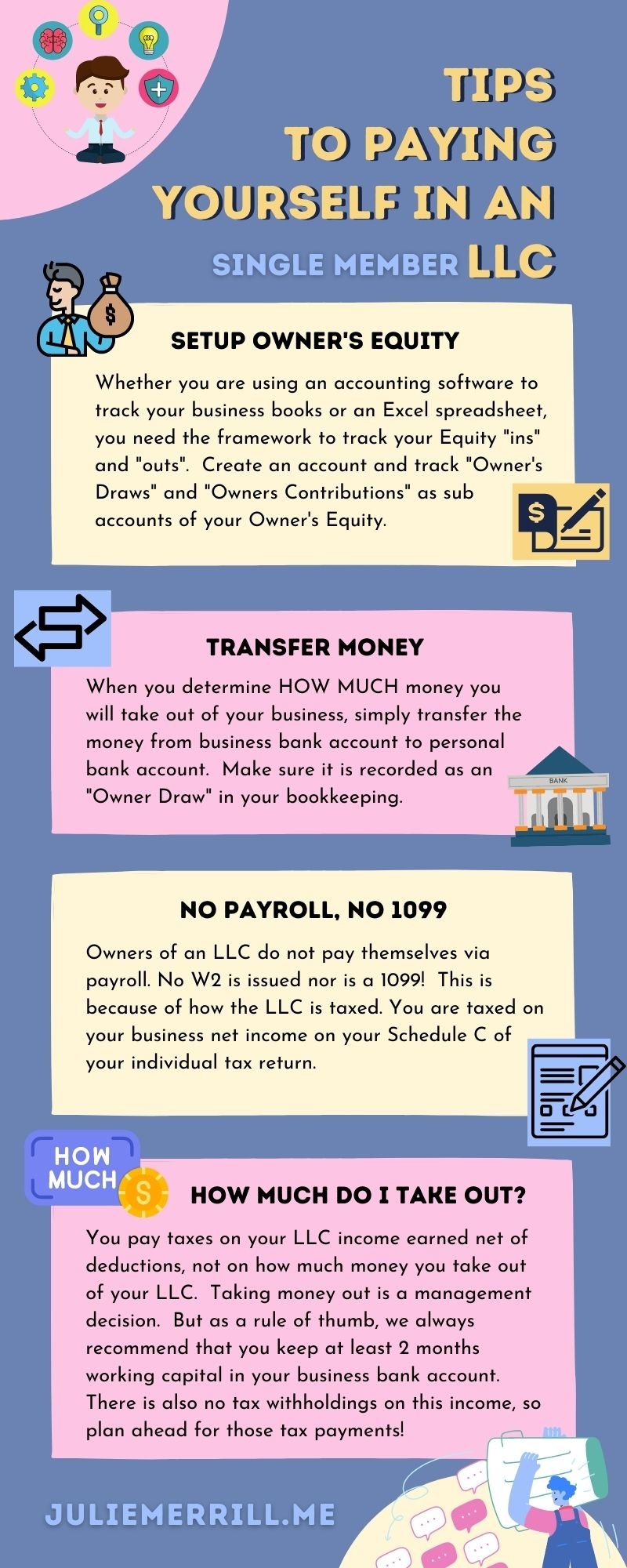

The determination of the EQUITY component varies according to the type of unit and is critical to establishing success. Likewise, when we set up QuickBooks Online for clients, we include a custom chart of accounts for a single member LLC.

Best Business Bank Accounts For (july 2024)

In a single member LLC, your equity section includes the owner’s equity account. It is recommended to have an account below the owner’s deductions and owner’s fees.

When you add money to your business, it’s a donation from the owner. When you withdraw money from your business, it is an owner’s deduction.

Bank to bank transfers are the easiest way to add money to your business or take money from your business.

Since you have an LLC in place, you must have a business bank account for your LLC.

Business Checking & Savings Accounts

It not only simplifies your business books, but is also a necessity for an LLC (you don’t have personal and business assets).

(unless they choose otherwise). What this means is that the LLC entity itself does not pay income taxes, but instead reports the income and deductions to the owners on their tax returns.

You only get paid as an LLC if you have no employees!

In fact, employing your children or spouse and adding them to your payroll is a great tax-saving strategy, and we have a free guide you can download on the subject.

Chase Checking Accounts

As a single member LLC, you report your business activity on Schedule C on your tax return.

You pay tax on the income from the investment, not the amount you withdraw or withdraw.

As a rule, we always recommend that you keep at least 2 months of working capital in your business bank account to cover future expenses.

If you don’t record business expenses, you lose tax credits and your taxable income goes up.

Do You Need An Llc For Online Business?

If you need help setting up a QuickBooks Online account, let us know. This is one of the personal glove CFO services we offer.

Think about how you were paid as a company employee, your W2 projects going forward, and estimated taxes withheld.

It is smart business to set aside a percentage of your income for tax planning. Making quarterly estimated tax payments is important.

If you don’t, you’re living on money that isn’t yours. You are taking out a loan from the IRS and possibly your state.

Free Direct Deposit Authorization Form

When we file tax returns for clients, this is the schedule we provide. But if the numbers have changed or you need an updated payment, get in touch and we can help.

Need help from a CPA with your taxes, business formation or tax planning? Email us or book a call here [email protected].

Julie Merrill is a certified public accountant, business and tax professional with over 25 years of experience serving small businesses to large corporations. He now owns and operates his own tax system.

The information provided in this post is for informational purposes only and is not intended to be tax or legal advice. For personal tax and legal advice, consult your legal team or tax advisor. Running an online business is a fun activity, isn’t it? The digital environment has changed the way business owners like you and me bring our dreams to life. We can reach clients all over the world, work from the comfort of our homes (in our PJs!), and get our business plans moving quickly. It’s a changing world, and that change comes with risks and rewards.

How To Accept Payments With Direct Bank Transfer In WordPress

I’m always interested in how online businesses are changing the legal game. They differ from traditional brick-and-mortar models in many ways, but they share a basic truth: all businesses, no matter what they are, come with challenges and opportunities. And all businesses deserve and need legal protection.

Today, I want to dive into a topic that will be very useful in your online business journey: creating a Limited Liability Company (“LLC”) or LLC. Trust me when I say that an LLC can be a game changer for your online business. In this post, I will spend my time discussing what an LLC can do for your online business and guide you through the steps you should take. Whether you are an experienced Internet entrepreneur or just starting your own Internet business, this information will be helpful. By the time you’re done reading, you’ll have a solid understanding of why an LLC is the right choice for your online business and how to get started down the road.

Let’s start by understanding why internet businesses are special. Unlike traditional businesses, we often operate in a virtual environment. We rely heavily on technology, digital marketing and e-commerce platforms to market and engage with customers. We are often customers who have never met face to face or had a permanent relationship. This modern approach has its own unique advantages, but it also exposes it to various risks such as timely payments, cyber security threats and complex regulatory compliance issues.

Despite these challenges, online businesses offer great potential for growth, scale, and revenue. However, it is important to protect yourself from personal liability that may arise. This is where LLC formation comes into the picture.

How To Start An Llc In California

An LLC provides a protective shield for your online business. In theory, an LLC separates your personal assets from your business liabilities, reducing your level of risk and exposure in the event of legal problems or financial difficulties in the business. Additionally, an LLC also provides tax benefits, flexibility in management structure, and a professional image for your online business. Generally, this is a good move for business owners who want to protect their wealth and effectively manage their online business. (Note: Always consult with your CPA/accountant and/or attorney to understand the legal, financial and tax implications an LLC has for you.)

At its core, an LLC is a legal structure that combines the limited liability protection of a corporation with the flexibility and convenience of a partnership or sole proprietorship. It is a mixed business that has gained great popularity among businessmen for many compelling reasons.

First, forming an LLC provides an important layer of protection for your personal assets. When you operate as a sole proprietor or general partnership, your wealth is intertwined with the elements of your business. This means that in the event of legal problems, lawsuits or lawsuits involving your business, your personal liability increases and your savings, real estate and other assets may be at risk. However, an LLC separates your money from your business liabilities, ensuring that your personal assets are protected.

It is important to note that some states do not provide owners of LLCs, known as single member or single member LLCs, the same level of liability protection as other states. It is important to determine where your state falls on the liability spectrum as a sole proprietorship LLC.

Llc Account: Fill Out & Sign Online

But an LLC is not about asset protection; An LLC offers flexibility and ease of management. Unlike a corporation, which often has complex administrative requirements, an LLC allows you to maintain a simple structure. You have the freedom to choose how you want to run your business as a sole proprietorship LLC or with a management team.

Additionally, the credibility and professionalism associated with an LLC helps build trust with customers, partners, and investors. This shows that your online business is a legitimate and well-established entity. If you are looking for a way to start a legal business, an LLC is a great way to make it legal.

The question on the minds of many internet entrepreneurs is, “Do you really need an LLC for your internet business?” Well, the answer is not the same, but an LLC is often the recommended choice for online businesses because of what it brings to the table.

One of the best things about forming an LLC for your online business is the security it provides. As we navigate the vast digital world, we face a variety of risks, from potential legal disputes to financial liabilities. An LLC acts as a shield that protects your personal assets such as savings, real estate and investments if your online business faces legal problems or liabilities. It’s peace of mind now and in the future, ensuring your hard-earned assets are safe.

Steps To Take If You Decide To Form An Llc For Your Startup

Tax considerations are an important aspect of any business, and an LLC provides flexibility in this area. By default, LLCs are taxed as pass-through entities, meaning that the business’s profits and losses pass through the owner’s tax return. This can easily lead to tax savings, especially as your online business grows. Being able to choose how you are taxed (as a sole proprietor, partnership, S corporation, or C corporation) provides flexibility as your financial situation changes.

Starting an LLC for your online business

Setting up llc, setting up an llc in nevada, setting up an llc in georgia, setting up an llc in maine, setting up an llc in new mexico, setting up an llc in michigan, setting up an llc in washington state, setting up an llc in minnesota, setting up a bank account for an llc, setting up an llc, setting up bank account for llc, setting up an llc online