Statement Of Changes In Retained Earnings – Entrepreneurship is not just about ideas, plans, strategies or tactics, it is also about numbers. Before starting a business, you need to have basic knowledge of financial indicators.

One of the most important financial indicators that show the efficient operation of a business is retained earnings. In today’s article, we will discuss the definition, calculation and consequences of retained earnings.

Statement Of Changes In Retained Earnings

Simply put, retained earnings represent cumulative earnings after all expenses and distributions have been paid to business investors. This portion of the company’s net profit is often used to reinvest in the business itself. Retained earnings are also called retained earnings or undistributed capital.

What Is A Cash Flow Statement? Example And Template (2023)

By definition, a company has shareholders who partially own the company by investing their capital in it. These shareholders demand a share of the company’s net income, paid in dividends or cash.

Generally, when a company generates positive earnings (profits), corporate management has some options for using that money. They usually pay these profits out to shareholders as dividends. But they may also decide to give the rest back to the company to maintain growth.

The remaining net income after dividend payments to investors are reported as retained earnings. This amount is added to the previous period’s retained earnings.

The purpose of this income deduction varies from company to company. Some companies use this money to purchase new equipment and materials. Others spend on research and development. The common goal is to earn more in the future.

Solved] Question Problem 12 6a Share Transactions, Dividends, Statement Of…

When and how an organization spends this money depends on its financial situation. In some cases, it may make sense to wait a few quarters or even a few years.

Retained earnings are not fixed. Regularly adapts to changes in the company’s operations and strategies. If the company incurs a net loss, retained earnings may turn into retained earnings or retained losses.

Additionally, if a business anticipates that it will not be able to receive sufficient capital, it may choose to distribute its earnings to shareholders.

From a financial accounting perspective, the amount of retained earnings falls under the ownership interest in the company’s stock. They are reported for each accounting period, usually monthly, quarterly and annually. A few companies also include retained earnings in their income statements.

Statement Of Stockholders Equity Explained

Since retained earnings are an important financial performance indicator related to the economic value created over time, companies also prepare retained earnings statements. These statements describe changes in the amount of retained earnings during a particular accounting period.

Now that we have an overview of retained earnings, we want to delve a little deeper into the term by briefly comparing it to other financial definitions.

Income and reserves are similar but not the same. Real capital goes to retained earnings.

Reserves are the portion subtracted from net income before dividends are paid. Meanwhile, retained earnings remain after dividends are paid.

Lo 2.3 Prepare An Income Statement, Statement Of Retained Earnings, And Balance Sheet

Companies keep reserves in order to strengthen the financial situation of the business and cover future losses.

Revenue is the most important figure reflecting a company’s financial performance. In retail businesses, revenue is also known as gross sales. However, revenue has a broader meaning when you calculate the total revenue of any activity, not just sales.

Operating expenses are calculated before operating expenses. Retained earnings are part of the income stream but come after all expenses and distributions have been paid.

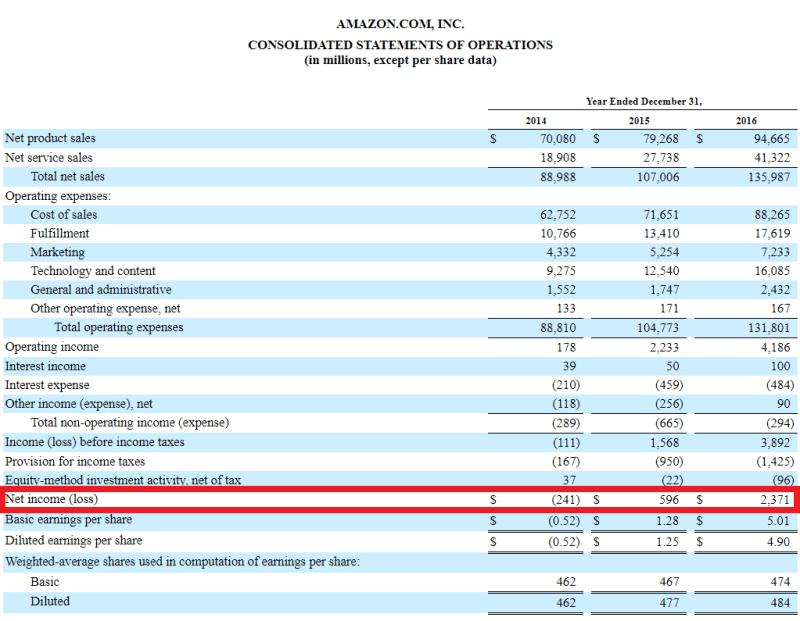

Net income is the bottom line used to show the financial performance of an organization. This includes all business expenses, salaries, taxes, etc. is the income after deduction.

What Are Retained Earnings? How To Calculate Retained Earnings?

Retained earnings and net income are closely related. Any change in net profit directly affects the retained earnings balance.

Dividends are part of the company’s profits and are paid periodically to shareholders. Dividends can be in the form of cash or shares. Retained earnings are earnings that reduce net profit.

Both types of benefits reduce retained earnings balances. Cash dividends are cash flows that reduce assets on a company’s balance sheet. Dividends reallocate some retained earnings to stocks, which reduces the value of each share.

In general, retained earnings are negative. When a business makes a loss, the net loss is recorded in the retained earnings statement. If the net loss is greater than the previous retained earnings, these retained earnings will be negative. In this case, the company has a deficit.

Nathan Liao, Cma Coach On Linkedin: The Statement Of Changes In Equity What It Doesn’t Tell Us👇 While It…

Even profitable businesses can report negative earnings. At this point, the company is issuing more stock than cash.

A negative retained earnings can sometimes be an early sign of potential bankruptcy as it can indicate a level of loss.

We can calculate retained earnings by adding past retained earnings to current net income (or loss) and then subtracting dividends paid.

Beginning earnings are the closing balance of retained earnings for the previous accounting period. You can get this figure from the balance sheet in the previous report. If your business has just started, this number will be zero. If your initial retained earnings are negative, be sure to enter the correct name.

Investments Requiring Consolidation

Net income is the net profit or net income your company produces. It is the decrease in expenses, interest and taxes. If your company made a profit, this number will be positive; if it made a loss, it will be negative. You can find this number at the bottom of your income statement.

Dividends paid are payments made to your company’s shareholders. Dividends can be paid in shares, cash or other forms. The board of directors decides the amount of dividends paid and approved by shareholders.

Most companies pay quarterly dividends. Some also pay monthly or semi-annually. Information about the stock is usually published by the board of directors and includes only the price per share. Therefore, you need to multiply the price per share by the number of shares.

It’s time to do math together to understand better. For now, let’s assume your business has the following numbers:

What Is Shareholders’ Equity?

Your company currently has earnings of $38,000. You can then reinvest that money into your business by purchasing equipment, improving your website, or looking for some investment opportunities there.

The money your company keeps as retained earnings can provide a more accurate indication of your business’s financial performance than net income or income.

Indicators such as income, expenses or net income change from month to month. Meanwhile, retained earnings provide a longer-term view of how your company earns, retains and invests.

Retained earnings can be confused with profits or money remaining after distributions. Actually they are not. Conversely, retained earnings refer to how the company uses its profits.

Statement Of Owner’s Equity

To expand and grow, a company must continue to operate and invest in new products or services. Capital-intensive or growing companies tend to make more profits than others. If the company spends its retained earnings wisely, the value of the stock will increase significantly.

The total amount of earnings not distributed over a certain period of time may not provide sufficient information. Longer observation may even reveal the company’s assets.

The most important criterion that boards of directors and investors should pay attention to is the return on retained earnings. It is important to evaluate how the company uses its reserves. By calculating the market value of retained earnings, you can evaluate the change in stock price relative to the company’s retained earnings.

The company uses its profits not only to pay dividends to shareholders but also to grow the business. First, retained earnings, current retained earnings can represent growth patterns from one year to the next.

Top 35 Accounting Interview Questions

We hope you have gained some foundation and practice with retained earnings. We’d love to hear more and share your thoughts!

Make sure your store not only looks great but also thrives with a professional and affordable team. More than 1.8 million professionals study accounting, financial analysis, modeling and more through CFI. Start with a free account and always find over 20 tutorials and hundreds of financial templates and cheat sheets.

Retained Earnings (RE) are the retained portion of business profits that are not distributed as dividends to shareholders but are retained for reinvestment in the business. Typically this money is used to purchase working capital and fixed assets (capital expenditure) or to repay debt.

Retained earnings are reported in the equity section of the balance sheet at the end of each accounting period. To calculate RE, the initial RE balance is added to net income or subtracted from net loss, then dividends are deducted. A reportable summary of retained earnings is also maintained, detailing changes in RE over a period of time.

Statement Of Changes In Stockholders Equity

Reserve income

Prepare retained earnings statement, statement of retained earnings formula, how to prepare statement of retained earnings, statement of retained earnings, income statement retained earnings, statement of retained earnings definition, the statement of retained earnings, accounting statement of retained earnings, how to do statement of retained earnings, purpose of retained earnings statement, sample statement of retained earnings, statement of retained earnings format