Student Loan To Pay Off Credit Card – Author: India Davis. India Davis Arrow Right Credit Card Editor India Davis is an editor specializing in credit cards and credit card processing. They believe in putting the reader first and branding first. He has worked in three different countries and hopes to learn more about the post-pandemic world. India Davis

Edited by Tracy Stewart. Tracy Stewart Left to Right Credit Card Magazine Editor-in-Chief Tracy Stewart is a financial writer specializing in credit card loyalty programs, travel discounts and consumer protection. Connect with Tracy Stewart on LinkedIn Connect with Tracy Stewart at Tracy Stewart

Student Loan To Pay Off Credit Card

. The information on this website is current as of the date of publication; however, some of these features may disappear. Terms and conditions apply to offers made on this website. Any opinions, analysis, comments or suggestions expressed in this article are the author’s own and have not been reviewed, endorsed or approved by any credit card issuer.

Debt Payoff Tracker Printable Bundle Credit Card, Car Loan, Mortgage Loan, Student Loan, Personal Loan

Our goal is to demystify credit card companies—whether you’re traveling or wherever you are—and make them more self-reliant. Our team consists of a variety of professionals, from credit card experts to data analysts and, most importantly, card shoppers like you. With this combination of knowledge and perspective, we keep an eye on the credit card industry throughout the year:

, we focus on what matters most to customers: rewards, welcome bonuses, APR and overall customer experience. Each provider discussed on our website is evaluated based on the value it offers to customers at each level. We test ourselves at every step, prioritizing accuracy, so we are ready to follow your every step.

We follow a strict quality control policy so you can be sure we are putting your best interests first. Our award-winning editors and reporters produce honest, accurate content to help you make smart financial decisions.

We appreciate your trust in us. Our goal is to provide our readers with accurate and unbiased information, and we have policies in place to achieve this goal. Our editors and reporters carefully review the content to ensure that what you are reading is accurate. We maintain a firewall between advertisers and employers. Our editorial team receives no compensation from advertisers.

What You Can Do When You Can’t Make A Loan Payment

Editors write on behalf of YOU, the reader. Our goal is to provide you with the best advice to help you make smart financial decisions. We follow strict guidelines to ensure that our content is not influenced by advertisers. Our editors receive no compensation from advertisers and are carefully vetted for accuracy. Therefore, whether you are reading articles or reviews, you can be sure that you are getting reliable and trustworthy information.

You have questions about money. there are answers. Our experts have been helping you manage your money for over four decades. We are committed to providing our clients with the professional advice and tools they need to succeed throughout their financial journey.

Maintains strict rules so you can be sure that the content we write is true and accurate. Our award-winning editors and reporters produce honest, accurate content to help you make smart financial decisions. The content produced by our editors is objective, factual and not influenced by our advertisers.

We talk openly about how we can provide quality products, competitive prices and useful tools, and we also explain how we make money.

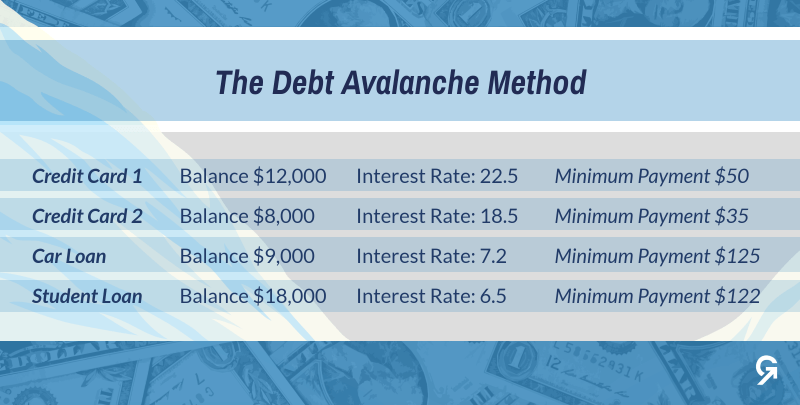

How The Debt Snowball Method Works

Independent publishers and an ad-supported comparison service. We receive compensation when you display sponsored content or click on other links posted on our site. Therefore, this return may affect how, where and how things appear in the listings, except to the extent that the law prohibits mortgages, mortgages and other mortgage products. Other factors, such as individual site policies and whether products are offered in your region or the region you have selected, may also affect how content is displayed on this site. Although we try to provide a variety of offers, we do not include financial or commercial information or any rental services.

It’s no secret that credit cards offer high fees. There are holiday cards, business needs and even cars. But can credit cards help with one of the most debilitating expenses of adulthood?

According to student loan debt, nearly 60 percent of US adults are hesitating to make an important financial decision because of student debt. Although there has been some relief in recent years, interest on student loans resumes at zero on September 1 and payments begin in October. If you’re thinking about using a credit card to pay off student loans, it’s possible, but it just makes sense sometimes.

Before going down this route, take the time to read about the risks of paying off student loans with a credit card, such as losing your government security or high interest rates on your loan. If you’ve chosen the benefits over the risks, here’s how to do it.

Should You Get A Loan To Pay Off Credit Card Debt?

Most credit card issuers require funds to be deposited into a bank account, making it difficult to pay with a credit card. Log into your student loan account and go to payment options. Start paying and see if you can pay by credit card. If not, consider the following:

Although a mediator often has a bad reputation, this can help you. When you pay your student loans through a third-party site, you can pay them using the recipient’s preferred method (eg, bank deposit, or money order) while charging by credit or debit card. In this way, you can pay off large debts that are usually not accepted for payment by credit card. Not only does this method allow you to manage your finances, but it also allows you to earn interest on bills that are often past due.

Cons: Although you can earn rewards, these services usually pay every fee. This amount may exceed any rewards you may receive on your purchase. You should also know the different working hours of the payment method accepted by the lender and plan accordingly.

The best card for this option: the Chase Sapphire Preferred® Card. Although this card offers you a small amount of cash back on regular purchases, using it to pay off your credit card can earn you a welcome bonus. This can be converted into a loan statement that can be used to pay the full amount. You can also use the bank transfer option with Chase to avoid paying in full.

Student Loan Debt Elimination

If you want to avoid paying for third-party sites and take the direct route, consider simple. Like a personal check, it allows you to use the funds available on your credit card and can be paid directly to the recipient. You can use it anywhere regular checks are accepted, and it’s a great way to bypass the credit card barrier for most student loan applications. It can be processed quickly because you don’t need to connect to another service.

Cons: Be very careful. Simple checks charge the same interest rate as interest, which can be 29 percent or more. You should use this option if you have the money to pay off the loan immediately and just want a reward.

The best card for this approach is the Blue Cash Everyday® Card from American Express. American Express has the best customer service of any credit card issuer, so if you’re struggling to navigate the process (approval, application, processing, etc.), the process should be painless. Although this card has a 0% introductory APR on purchases and money transfers for 15 months from account opening (adjustable APRs thereafter of 19.24-29.99%), this does not apply to convenience checks.

Now that you know how to pay off student loans using a credit card, you need to think about your repayment plan. Looking to build a bigger credit card balance? Or do you plan to continue making small, regular payments each month?

Student Loan Borrowers ‘live For Today’ When It Comes To Spending

There are many credit cards that offer 0% interest for new cardholders, meaning you won’t have to worry about interest for a short period of time. Most offers last from 12 to 18 months, but some last up to 21 months. If you don’t have enough money in your bank account to pay your bill right away, this is your option.

Cons: While most credit card APRs are close to the national average, credit card APRs tend to be higher than student loan APRs. You want to make sure you can pay off the loan in full before the 0 percent interest period ends.

Very nice card