The Difference Between Net And Gross Profit – Gross profit, operating profit, and net profit are reflected in a company’s income statement, with each metric representing profit from a different part of the production cycle and profitability process.

If the earnings show that the company has a positive cash flow, calculating the net income is more complicated. Profit generally refers to money left over after expenses have been paid, but gross profit and operating profit depend on when certain revenues and expenses are taken into account.

The Difference Between Net And Gross Profit

All three financial ratios (gross profit, operating profit, and net profit) are found on a company’s income statement, and the order in which they appear indicates their importance and relationship.

Difference Between Revenue And Profit

The first line of the income statement reflects the company’s total revenue, i.e. revenue from the sale of goods or services. Using revenue data, add and subtract different expenses and alternative revenue sources to arrive at different profit levels.

Gross profit is total revenue less the costs directly related to the production of goods sold, known as cost of goods sold (COGS). COGS represents direct labor, direct materials or raw materials, and the portion of manufacturing costs associated with a manufacturing unit.

Cost of goods sold does not include general expenses such as office expenses. The cost of goods sold directly affects the company’s gross profit, which reflects the income remaining to finance operations after accounting for production costs. Gross profit does not include the cost of debt, taxes or other expenses necessary for the operation of the company.

Operating profit is derived from gross profit, which is the remaining income after all expenses have been included. Operating profit is also known as operating income or earnings before interest and taxes (EBIT). EBIT may include non-operating income that is not included in operating profit. If the company had no non-operating income, EBIT and operating profit would be the same.

Net Profit Margin: Formula And Calculation

In addition to cost of goods sold, it includes fixed costs such as rent and insurance, as well as variable costs such as transportation and freight, wages and overhead, and depreciation and amortization of assets. Operating profit does not take into account the cost of debt interest payments, tax costs or additional income from investments.

A company’s profit is called net profit or net income. Since net profit is the last line at the bottom of the income statement, it is also called the bottom line. Net income represents the total residual income after taking into account all positive and negative cash flows.

Using operating profit data, subtract debt expenses, such as loan interest and taxes, and one-time items for unusual expenses, such as equipment purchases. Any additional income from secondary activities or investments and one-off payments such as the sale of assets are added.

Net profit is the most important financial indicator that reflects a company’s ability to generate profit for its owners and shareholders.

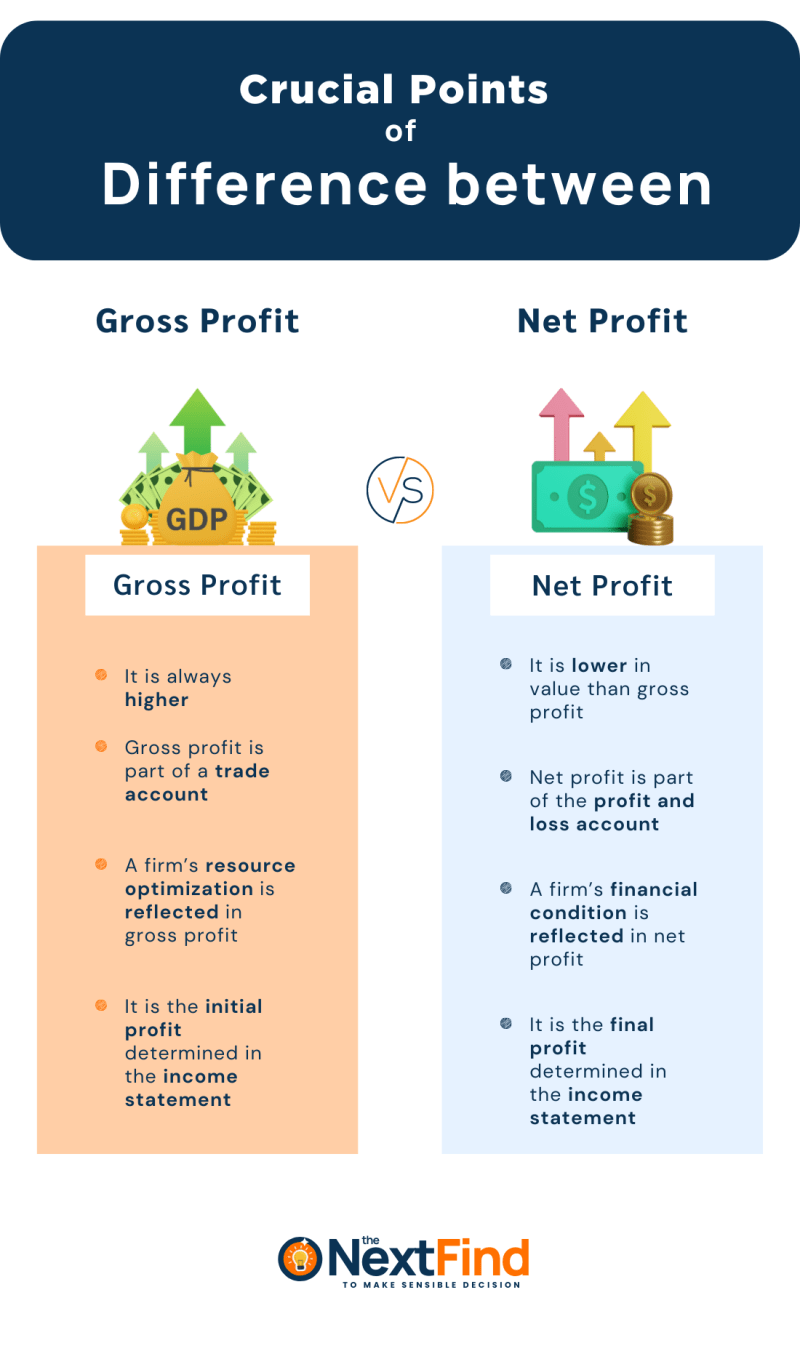

Understanding What Is The Difference Between Gross Profit & Net Profit?

For business owners, net income can help them understand how profitable their business is and what business expenses they need to cut. For investors looking to invest in a company, net income helps determine the value of the company’s stock.

Operating income is the company’s total income minus operating expenses and other business-related expenses, such as depreciation. The difference between EBIT and operating income is that EBIT includes non-operating income, non-operating expenses and other income.

The bottom line is the company’s net profit and the last number on the company’s income statement. The bottom line is the company’s revenue after all expenses have been deducted from revenue.

Gross profit, operating profit, and net profit are shown on a company’s income statement, with each metric representing profit at a different stage of the production cycle. Gross profit is total revenue minus cost of goods sold (COGS). Gross profit, operating profit or operating income is the remaining revenue after all expenses plus cost of goods sold. Net income is a company’s bottom line or income after all cash flows, both positive and negative, are taken into account. Calculating business profits can show how much money your business is bringing in. You can also compare profits from previous accounting periods to determine growth. Businesses must process and calculate two types of profit: gross profit and net profit.

Gross Profit Vs. Net Income: What’s The Difference?

Understand gross profit and net profit to make business decisions, prepare accurate financial statements, and monitor your financial health.

Profit is the amount of money your business makes. The difference between gross profit and net profit is the result after deducting expenses.

Gross profit is your company’s revenue minus cost of goods sold. Cost of goods sold (COGS) is the amount of money you spend directly to produce your product. But other expenses of your business are not included in your COGS. Gross profit is your company’s profit before expenses.

:max_bytes(150000):strip_icc()/Screenshot2024-02-06at10.40.24AM-cc28ee3c791844a88b761cce13bcac43.png?strip=all)

Net profit is the company’s income after deducting all operating expenses, interest and tax expenses, and cost of goods sold. To calculate net profit, you need to know the company’s gross profit. If this number is negative, your company’s net profit is called a net loss.

Difference Between Gross Profit And Net Profit

Your business can have a higher gross profit and a significantly lower net profit, depending on how many expenses you have.

Report gross and net income on your small business income statement. Your income statement shows your income, then your cost of sales, and your gross profit. The next section shows your operating expenses, interest expenses, and taxes. The bottom line of your income statement is your net profit.

To find your gross profit, calculate your revenue before your expenses. Subtract all expenses from your revenue to find your net profit.

Your revenue is all the money you make from sales. Also, your cost of goods sold refers to the cost of manufacturing your product.

Gross Profit Vs Net Profit Explained

Let’s say your business has $12,000 in sales during the accounting period and $4,000 in total cost of sales. Subtracting $4,000 from $12,000 gives a gross profit of $8,000.

Remember that your gross profit is not the bottom line of your business. Your gross profit does not represent your salary as a business owner or the amount of money you have to reinvest in your business. However, you can use gross profit to calculate net profit.

Operating expenses, interest and taxes make up the total cost of your business. Examples of operating expenses include expenses such as rent, depreciation, and employee wages.

Using the gross profit example above, let’s say your company’s gross profit for the reporting period is $8,000. You also have $1,000 in rent, $250 in utilities, $2,000 in employee wages, $300 in inventory, $500 in depreciation, $1,000 in taxes, and $250 in interest.

What Is Gross Profit? How To Find & Calculate

First, calculate the total cost of your business. Your total costs are $5,300 ($1,000 + $250 + $2,000 + $300 + $500 + $1,000 + $250).

Now you can subtract the total expenses of $5,300 from the gross profit of $8,000. Your company’s net profit is $2,700.

Investors and lenders want to understand the financial health of your business, and showing gross profit doesn’t make it any less of a financial health issue. When looking for a foreign loan, you need to know the net profit of your company. This way investors and lenders can determine how much money you have after all fees are paid.

To prepare an income statement, you need to know how to calculate gross profit and net profit. Confusing the two will only result in confusing and inaccurate documentation.

What’s The Difference Between Revenue And Profits?

You also need to understand the difference between gross profit and net profit in order to make informed business decisions. Understanding your business’s gross profit can help you find ways to reduce your cost of goods sold or increase the cost of your products. If your net profit is significantly less than your gross profit, you can identify a cost reduction.

To calculate your company’s gross and net profit, you need organized and accurate books. With Patriot’s online accounting software, you can track your income and expenses to track your company’s finances and create financial reports. Start a free trial!

Get started with a free payroll setup and enjoy free expert support. Try our payroll software with a free, no-obligation 30-day trial. To understand the financial health of your business, you need to pay special attention to two types of profit – net profit and gross profit. Because if you don’t know the financial health of your business, you’re operating blindly, which means you can’t make informed decisions about the future.

Gross profit (also called gross income) is the profit that a company receives after deducting production costs, while net profit (called net profit) is the profit that remains after deducting all costs (insurance, taxes, wages, etc.).

Difference Between Gross Profit & Net Profit

So, if you have come across these two terms before but never understood the difference between them, this blog is for you. Read on to learn more about each type of profit and how to calculate it for your business.

If you’re in the business of manufacturing, gross profit, business profit, is the number you get after subtracting production costs from revenue. Gross profit, or total revenue, helps you understand your business’s operating and production costs, which helps show if you’re losing money.

If your operations

What is the difference between net income and gross profit, difference between gross and net profit margin, what is the difference between gross profit and net profit, the difference between gross and net profit, difference between gross and net wages, difference between gross and net pay, what is the difference between gross and net pay, difference between gross profit and net profit, explain the difference between gross profit and net profit, what's the difference between gross profit and net profit, difference between net income and gross profit, difference between gross profit and revenue