The Difference Between Revenue And Income – Earnings and earnings are terms commonly used by companies to describe their financial performance over a period of time. Profit and revenue are two of the most scrutinized numbers in a company’s financial statements.

Investors and analysts use these numbers to determine a company’s profitability and assess the company’s investment potential. Here we look at the difference between earnings and income and show examples of both as they appear in actual financial statements.

The Difference Between Revenue And Income

Revenue is the total amount of money a business makes from the sale of goods and services. Many analysts use the terms sales and revenue interchangeably. Companies typically report their income quarterly and annually in their annual financial statements. A company’s financial statements include balance sheets, income statements, and cash flow statements.

Brian Feroldi On Linkedin: Revenue ≠ Profit Give Me 30 Seconds, And I’ll Explain The Difference! →…

Sales revenue is called the top line because it appears at the top of the company’s income statement, which also refers to the company’s gross sales. Revenue is the income generated before expenses are deducted. In some companies, sales revenue is also called net sales revenue, since net sales revenue also includes returns of goods by customers.

On the other hand, profit represents the bottom line of the income statement and is the profit earned by the company over a period of time. The profit figure is shown as net profit on the income statement. When investors and analysts talk about a company’s earnings, they are talking about the company’s earnings or net profit.

Effective cost management in relation to revenues depends on whether the company will have a positive profit or loss.

Businesses calculate net income or income by deducting from income operating expenses such as depreciation, interest on loans, general and administrative expenses, income taxes, and operating expenses such as rent, utilities, and payroll expenses. The company’s operating results are also called net profit.

Operating Income Vs Net Income

A business can be considered financially successful based on revenue alone. Company management will often praise increased sales when discussing future prospects; However, revenue alone does not provide a complete picture of a company’s financial situation.

We also need to consider the costs the company incurs to generate revenue. If a company’s revenue is greater than its costs, it will make a profit. On the other hand, if the company’s expenses exceed its revenues, the company is operating at a loss.

Although a company’s financial statements may show that revenue is increasing quarter-to-quarter or year-to-year, the company may still experience financial problems if costs remain high. Therefore, estimating a company’s profit – which subtracts expenses from income – is important for assessing the company’s long-term sustainability.

This is brief background information about Apple Inc. as of the end of fiscal year 2022 from the company’s 10-K filing.

Income Statement: Definition, Preparation, And Examples

Apple Inc. ( AAPL ) reported net sales of $394.328 billion during the period, up more than $28 billion from the same period a year earlier.

After recording income, Apple must deduct all expenses associated with running the business. This includes deducting cost of sales from sales, operating expenses, other expenses and provisions for income tax.

All these expenses reduce the revenue until the net income (profit). Apple posted a net profit of $99.803 billion in 2022 (an increase of $5 billion over the same period in 2021).

In general, revenue will not exceed revenue because revenue represents the total sales of the business. Revenue represents sales minus all related expenses; the company’s money takes the house. In cases where earnings exceed earnings, the business receives income from other sources, usually in one-time transactions, such as income from special investments. This will have nothing to do with the results of the operation.

Gross Profit Vs. Net Profit

Income is always profit, not income. Revenue represents the value of the goods or services sold by the company at the selling price. Income, also called profit, represents income less all costs associated with running a business: For example, selling costs and operating costs.

EPS is earnings per share. It is a financial ratio used in investment analysis. Earnings per share is calculated as net income divided by the number of common shares outstanding. The number shows how much money the company makes from each share.

The difference between revenue and earnings is that while revenue tracks the total amount of sales, revenue represents the proportion of revenue that the company remains in profit after every expense is paid.

While it is important for investors to assess a company’s earnings and profitability before making an investment decision, there are other metrics that investors can use in their analysis. For example, understanding some key financial ratios related to a company’s profitability, liquidity, solvency and valuation can help investors quickly find potential investments.

What Is Revenue? A Quick Refresher

Require writers to use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. Where appropriate, we also refer to original research from other reputable publishers. Read more about the standards we follow to create accurate and unbiased content in our editorial policy.

The offers listed in this table come from the partnerships from which they receive compensation. These compensations can affect how and where ads are shown. it does not include all the offers available in the market. Every investor invests his money in a company in order to get more profit from it. The profit is supposed to be an incentive for investors to take risks and lock in their funds. Profits can be increased by maximizing the company’s total revenue.

But usually these terms are used interchangeably, which is not true. So, to understand the difference between revenue and profit, we must first clarify the meaning of the two terms. These are explained below:

The total amount received or receivable from business or non-business activities is called income. The total amount is the amount without any fees deducted. This is the total income earned by the business during the financial year.

Revenue Vs Sales: Key Differences, Types And Examples

Usually, income is used for business income because non-business income is non-recurring and cannot be estimated.

The amount left after deducting the total amount of expenses and losses from the total income or income is known as profit. Profits can be roughly calculated into three sub-categories shown as follows:

The amount left after deducting the total amount of expenses and losses from the total income or income is known as profit.

Calculate the amount of income needed to know the total amount of income of the company

Difference Between Income And Revenue

The calculation of the amount of profit is necessary to know the amount of net income of the company.

Sales include all parts of the profit, so the profit depends on the company’s sales in a certain financial year. Any new startup should focus on its revenue first. If he has a good market share for his product, he will make a profit.

Write your feedback in the comment box. whatever you want. If you have any questions, ask us by posting a comment.

Share to Facebook Share to Twitter Share to Pinterest Share to WhatsApp Share to LinkedIn Share to Telegram Share to Email More than 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account and discover over 20 free courses and hundreds of financial tips and tricks.

Difference Between Profit Making And Non Profit Making Organisation

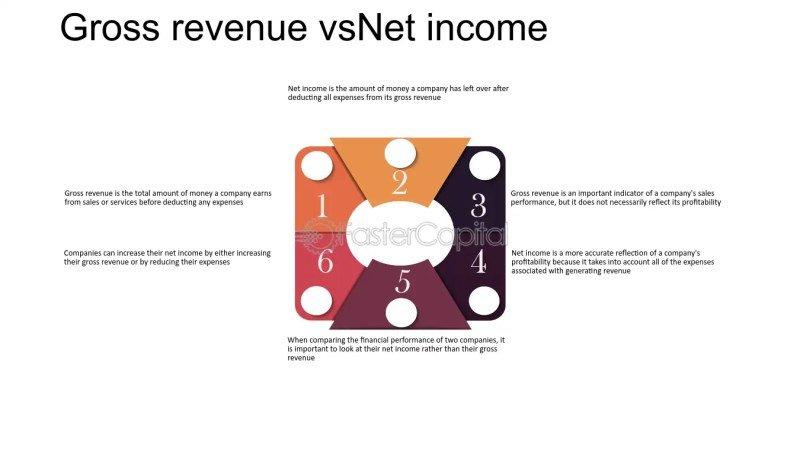

This guide provides an overview of the key differences between traffic and income. Revenue is the amount of sales a business makes from providing services or selling products (“top line”). Revenue can sometimes be used to refer to income, but it can also be used to refer to net profit, which is income minus business expenses (“bottom line”).

Let’s take a closer look at what turnover can mean by looking at examples of different types commonly found in the finance and accounting industry.

As explained above, the term “income” can sometimes be confusing because accountants often use it to refer to income. The term net profit clearly means after deducting all expenses.

Let’s look at some examples to further illustrate this point. Read each example below and see if you can figure out how you would classify it.

Understand Your Earnings: Gross Profit Vs. Margin (2024)

Tom’s Pizza Inc. sells pizzas, soft drinks, snacks and sauces directly to customers. Customers pay for products by credit card or cash. At the end of the year, Tom gives his accountant all sales receipts, as well as invoices and receipts for all wages, supplies, utilities, and food and beverage expenses. His accountant took all the receipts and told Tom that his ________ was $125,869. The answer is “net income”.

Sara’s Photography Ltd offers a wide range of services including portrait photography, wedding photography, family photography and special events. She bills the client upfront for this service and at the end of the year enters all the bills into a spreadsheet and finds that it _______ $248,120. The answer is “income”.

In accounting, the income statement (also called income statement) provides an overview of revenues, expenses, and net profit of a company.

Below is an example of Amazon’s 2016 annual report (10-k), which includes revenue (which they refer to as “net sales”) and net sales.

Difference: Fund Flow, Balance Sheet, And Income Statement

Difference between income and revenue in accounting, difference between revenue and operating income, difference between revenue and net income, difference between net profit and revenue, what's the difference between income and revenue, what is the difference between cash flow and revenue, difference between turnover and revenue, difference between profit and revenue, difference between revenue and earnings, the difference between gross and net income, what is difference between income and revenue, difference between income and revenue