Transfer Money To India Bank Account – Many Indians come to Europe every year. They are looking for opportunities to advance their careers or change them completely. Obviously, moving to a new country means getting money there – and there are many questions about how to spend it wisely.

How to rent an apartment in a new city? How do you open an account with a European bank? How to send money to India? These are some of the questions expats think about when settling in Europe. Ultimately, everyone will find their own best way to send money to India, but we hope this article will make the process easier for you.

Transfer Money To India Bank Account

The latter is becoming more and more popular, offers great offers and forces you to install apps that help you send money to India.

Know The Information Required To Transfer Money To India

If you google ‘how to transfer money to India’, you’ll find ‘complete guides’, ‘wide range’ of money transfer apps, etc. It’s understandable that many people are fooled by advertisements that promise fast payments or good exchange rates – but can these promises be trusted? And is choosing the fastest or cheapest solution enough?

When choosing the best way to send money to India, we recommend that you consider:

We also want to provide high quality money transfers considering all the concerns you have. While we try to be objective and help you choose the right online service or mobile app for you, we explain the terms of some popular financial services.

Money transfer services usually charge a fee. It is understood that some resources are required to power the complex infrastructure required to keep the transmission service running. However, paying commissions is not pleasant and sometimes difficult – the terms of transfer to other services are not clear enough.

How Much Money Can Be Sent From The Usa To India?

In the table below you can find popular (and cheap) money transfer options in India:

As you can see, most of the above services charge a transfer fee to India. This fee may vary depending on the transfer amount or other conditions. Many European expats are looking for cheap money transfers to India – managing your budget while living abroad is very important.

There are no fees for sending money to bank accounts in India – however much money you want to send abroad.

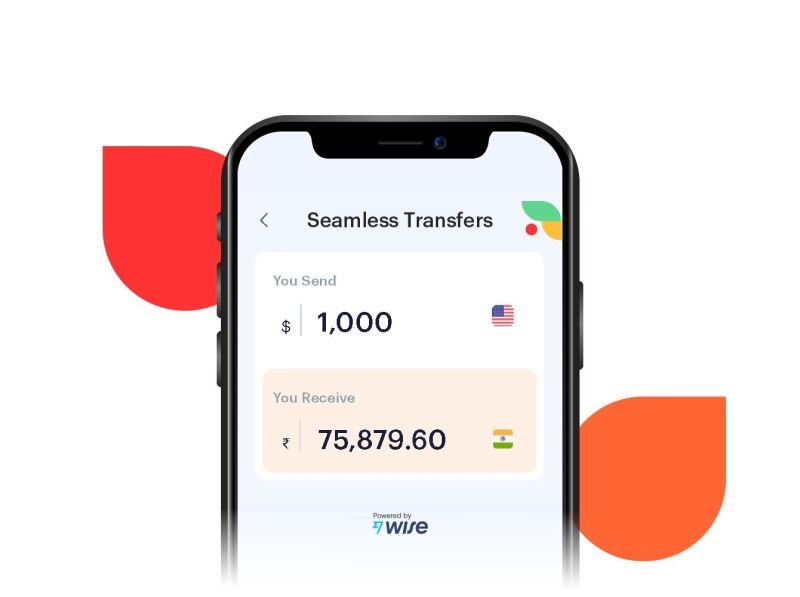

Here, the math is simple: If an online service or mobile application offers a more profitable exchange rate, you can send more rupees to India – to your loved ones or to your savings account in an Indian bank.

Know How To Link Your Bank And Add Money To Paypal Wallet India

Some services offer special terms for your first transfer – so let’s compare exchange rates for sending money to India for the first time. Check the table below for the best rates to send money to India.

As you can see, we offer the most profitable exchange rates among our competitors. We offer a promotional rate for sending money to India for the first time after creating an account with us – and we guarantee that your next transfer will benefit from our internal monitoring system.

If you’re wondering how to transfer money to India profitably, here’s a simple tip: stick to a commission-free service with a good EUR to INR exchange rate.

Meanwhile, some may argue that an international money transfer service is the best way to send money to India. Maybe some couriers or crypto brokers can offer you profitable money transfer conditions… But in this case you should not think only about the possible profit.

How Can I Send Money To India From Israel Via Upi

You may know that scammers and fraudsters often compromise financial services. With international shipping, it can be a challenge to find someone responsible for payment if something goes wrong. When sending money with a courier, you need to find someone you can completely trust. With cryptocurrency, you need to be an expert to work safely in India.

Here’s how to send money to India safely: Get a 100% legal transfer option – and never worry about getting your money home to your family!

Registered as an EMI (Electronic Money Institution), this means that when it comes to legal issues, the company has the same responsibility as any bank you used. EMIs are licensed to carry out financial activities and are governed by the laws of that country. In addition, it has a complete security plan: from the standard PCI DSS certification to the implementation of our solutions, we ensure that we take all necessary measures to keep international transfers – and our customers’ data – completely safe.

Many insist that the old wire transfer is the best way to send money to India. Many international and local banks have good reputations; They were established decades ago, and without them we cannot imagine any economic activity. Visiting a local bank and opening a debit card is one of the first steps every Indian takes when settling in Europe. However, banks have their problems.

What Is Hawala? Money Transfer Without Money Movement

Sometimes it may be necessary to send money to India urgently. Unfortunately, bank transfer is not the fastest way to send money to India. Banks have their own guidelines and may initiate additional checks when it comes to overdrafts. Providing the necessary details can be cumbersome and time-consuming – and if you have problems, your cheap money transfer to India can take several days to complete. Therefore, it is understandable that many applications that help to send money to India are gaining popularity. Many of them claim to have created the fastest way to send money to India – and in fact, the best money transfer services in India claim to provide fast delivery within an hour. It is much faster than bank transfer or couriers.

In addition, your transfer speed is always fast: send money from your bank card to an account in India and it arrives in minutes!

There is one more thing to consider when choosing the best way to transfer money to India: Although transactions are fast, the process of sending money can be complicated.

Last but not the least: A good money transfer app in India should be user friendly. You may have noticed that it can be difficult to find information about your initial transfer fee or the ‘best rates’ of various services that offer money transfers to India. Even before you learn how to send money to India, you may be confused by all the terms and conditions – not to mention the registration and transfer processes.

Your Family In The Us Can Send You Money On Google Pay: All Your Questions (hopefully) Answered

By, we want to create the best money transfer app in India and 50+ other countries – and if you don’t want to download the mobile app right away, you can try sending money from our website. You can see our current transfer terms without registering – enter the amount to be transferred to see the details.

It only takes a few minutes to register and send money to India in the best way. We have tried to simplify the process and reduce the steps you need to take to a minimum, so that the transfer is quick and convenient. At the same time, we use advanced technology to keep it safe. We have a step-by-step guide on how to send money to India, and if you have any questions, our customer service will be happy to help.

Choosing the best way to send money to India can be difficult, as there are many factors and nuances to consider. We offer free exchange service with fast and easy but secure profitable exchange rate. We hope you choose a money transfer service to India with the EUR-INR rate that suits you – but let us remind you that we are always accepting new customers.

This step-by-step guide will help you send money easily using your smartphone app.

Domestic Money Transfer (dmt)

Choose the best way to send money to a bank account in India. Send money to India quickly and safely!

Explore the vibrant Indian expat experience in Germany. Learn about community, cultural integration and practical tips for a successful life as an Indian expat in Germany.

The brand is registered as a trade name under Sybilla Solutions Limited. Sybilla Solutions LTD is registered in Cyprus (Registration No: HE348581) and regulated as an EMI by the Central Bank of Cyprus (License No. 115.1.3.16 / 2018). © 2023 Sybilla Solutions Ltd. All rights reserved. In this article, I am sharing my experience of sending money from UK to India using different methods: Bank Transfer, Ria MoneyTransfer, MoneyGram, Western Union, PayPal and TransferWise.

On several occasions, I have had to send small amounts of money to family members from the UK to India using traditional methods, online payment services and P2P money transfer methods.

Send Money To China Bank Account

Let’s analyze how much it costs today to send $500 from UK to India and receive it in India.

Transfer money from us to india bank account, bank money transfer to india, money transfer to bank account in india, how to transfer money to foreign bank account from india, transfer money to foreign bank account from india, online money transfer to bank account in india, how to transfer money to uk bank account from india, how to transfer money from usa to india bank account, transfer money to bank account, western union money transfer to bank account india, how to transfer money from india to us bank account, transfer money to someone else's bank account