Ways To Start Saving Money – If you’re looking for ways to build your emergency fund or pinch your money right now, try these 13 tips.

Whether you’re trying to save it or make it, the situation, whatever, money is on our mind. If you’re looking for ways to build your emergency fund or pinch your money right now, try these 13 tips.

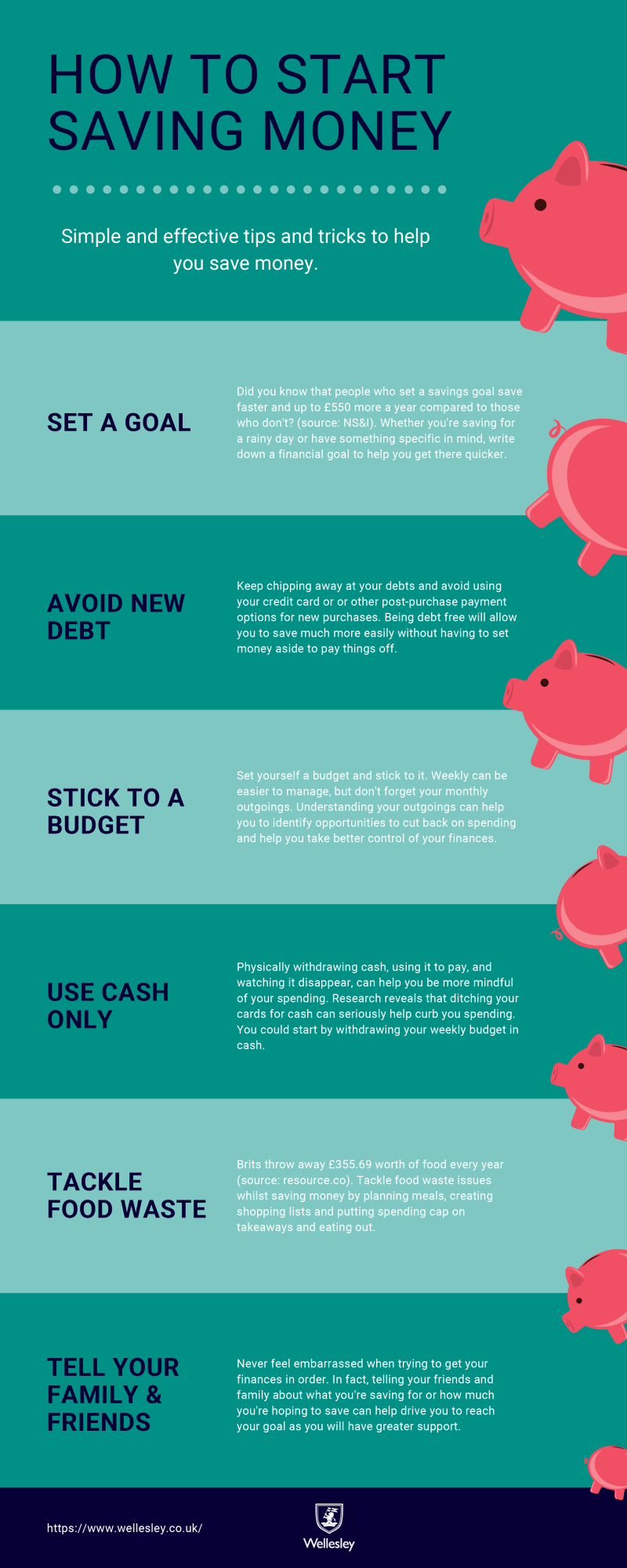

Ways To Start Saving Money

Cutting the cord can save you a lot. Switch to a subscription service like Netflix, Hulu, or Amazon Video. It is possible that you already use one of these services, so there will be no additional costs for you.

How To Start Saving Money When You Have None

Challenge yourself not to spend money, except for essentials like groceries, rent, and utilities, for the next 30 days. Keep yourself accountable by encouraging your loved ones or friends to join. If you find yourself adding a lot of items to your cart online, this can lead to expenses.

One of the best ways to save money is to pay off the debt. But if you’re struggling with money right now, paying off student loans can help pay the rent. As part of the CARES Act, federal student loans are forgiven with zero percent interest between March 13, 2020 and September 30, 2021. This is a great way to save money in the short term.

Save money by swapping lunches for leftovers and sandwiches. Save the money you save by cooking dinner more often to reduce the cost of pick-up and delivery. Try new recipes or start cooking challenges with your loved ones or roommates. It can create friendly competition with good results.

Lowering your credit card balance can be as simple as calling your credit card provider. Negotiate a better rate by improving your credit history and credit score. If your agent isn’t willing to lower your rate, look into changing costs. Transferring your balance to another card can help you save on interest over time, so you can focus on paying off your debt or saving money. If you’re having trouble paying your bills because of COVID-19, talk to your health care provider to discuss what you can do.

How To Save Money: 15 Simple Tips

How many emails do you receive a day from marketing companies offering you the latest promotions and telling you about unmissable deals? My thoughts are too many. Take 15 minutes to delete these emails so you don’t get tempted to buy things you don’t need. Shopping for technology won’t be on your mind if you don’t get reminder emails. Your wallet and your inbox, thank you.

Take the time to contact your auto insurance provider about what, if any, discounts you can get. Because of the pandemic, many companies are offering flexible options. Geico, for example, is still offering “flexible payment plans and/or special payment plans” for customers feeling the effects of the pandemic. And while you’re at it, see if you can lower your salary due to better management or longevity with the company. It doesn’t hurt to ask.

Even if money is tight, you can find a few dollars to save. Try to set aside $10 or $20 in your savings every time you get paid. It may seem small, but it is the first step to protect against accidents and unexpected expenses. Make it easy by setting up a bank transfer from your checking account to your savings account on payday. You always have money when you start paying yourself.

This is absurd. Food adds up, especially if you shop more than usual because you spend more time at home. Discount stores and regular brands help you save money on your grocery bill. Stop at Whole Foods to run now; you can find your pages elsewhere. Bonus tip: make a grocery list before you hit the road. Making sure you only buy what you need will keep your bill in check.

Six Ways To Teach Your Kids About Saving Money

Ideally, you set up your 401k contributions to be deducted from your paycheck and never have to think about it again. But when the going gets tough, check to see if you can temporarily reduce your contributions. A few percent can make all the difference in your budget right now. To continue to get the most out of your retirement, make sure you’re contributing enough money to match your company.

If there is something you have been wanting to buy, write it down. Whether it’s a new pair of shoes, a designer item, or a household item, writing down and waiting for a few days can help you decide if you want the item or if it’s a good thing to have. These tips will help you avoid buying things. If, after a week or two, you’re still thinking about something and can’t live without it, go ahead and buy it.

Even if it costs you money now, paying off debt will save you money in the long run. In the short term, you’ll save on interest by lowering your interest rate, and when you pay off your loan, you’ll save a whole lot of money. If you’re looking to lower your monthly payments or interest rate faster, consider paying off your student loans.

If you’ve been reading and find yourself spending too much money on books, don’t forget about your local library. In addition, many have online services where you can rent e-books or audiobooks. This will save you money and give you access to thousands of jobs that will keep you busy.

How To Start Saving Money: A Quick Start Guide

Danielle Doolen Danielle Doolen is a professional communicator and writer who loves work, women and lifestyle. His writing and expertise has appeared in Career Contessa, Insider, Motherly, PopSugar, PRSA Strategies & Tactics, Thrive Global, and more. He has a master’s degree in professional accounting from the University at Albany. By day, she works for a Fortune 500 car dealership, but her favorite job so far is being a mom. For more information, visit www.danielledoolen.com.

Multi-brand marketing isn’t just about Tupperware parties. With the economic uncertainty, MLMs are still up to their old scams. Why do MLMs and pyramid schemes target women? Learn more.

Want to pay off debt, increase your income, start investing, or look at your overall financial picture? We have several financial requests for you.

Do you want to manage your finances, pay off debt, or invest in your future? Here are the best podcasts for every budget.

Ways For Small Business Owners To Save Money [expert Roundup]

We show you the skills that will give you the best money. Do you have high income earning skills like Google Analytics, copywriting, etc.? We will see.

You know you need to save, but what’s the best way to save your money and watch it grow? High-yield savings accounts are an easy place to start when you’re ready to invest.

Are you looking to save money by reducing your spending? We have found you. Here are ways to save money on all the food and services you might not need.

When you want to know the salary for a new job or a long-term promotion, here’s how to create a salary equation to put it to work.

Smart Strategies For Saving Money On Your Business Startup Even If You’re On A Tight Budget

Every working woman has financial questions about debt, budgeting and retirement. We have answers to your tough financial questions.

By clicking “submit,” you agree to receive emails from Career Contessa and agree to our site’s terms of use and privacy policy As with most good practices, saving money is easier said than done. Once you start spending regularly, you may find yourself on autopilot when it comes to monthly expenses (and splurges).

But just like changing other habits, changing your safety habits is possible. With a dedicated mindset, a few lifestyle changes, and creativity, you’ll find yourself jumping into your savings and making progress toward your financial goals in no time.

The first step in changing any habit is to set your goal. Once you’ve made the mental commitment to increase your savings, consider whether some (or all) of these tips are right for you:

Ways You Can Save Money When You Work From Home — Ylopo

Once you’ve decided on your strategies, give them some time before deciding whether or not they’re working. Try not to give up on your new options until you’ve had a few months to make any changes.

A big part of joining a new fitness program is keeping your commitment in mind. Here are some tips and hacks to help you stay committed to your new fitness goals:

And, of course, celebrate your progress every time you reach a fitness goal or reach a milestone with a new habit.

Saving more money may mean a real change in your spending habits, but with commitment and purpose, progress is possible. As well as finding ways to spend less money, think about how to increase your income or pay off debts that are right for you, and try to set yourself short-term savings problems Saving can be difficult money.

How To Start Saving Money From Scratch

Where to start saving money, ways on saving money, ways to saving money, 101 ways to stop shopping and start saving, need to start saving money, ways to start saving money now, how to start saving money for retirement, easy ways to start saving money, how to start saving money, best ways to start saving money, tips to start saving money, ways to start saving