What Is The Best Way To Invest 10000 – Well, well, looks like we have a loaded couple in the room, don’t we? £10,000 may not be Warren Buffet money, but it’s a great start!

What should you do Go for property and real estate? Maybe try investing passively through ETFs? Should you aim for higher returns or go with lower risk? Is £10,000 enough to get you started?

What Is The Best Way To Invest 10000

If you’re ready to turn that nest egg into a golden goose, grab a coffee and start reading. This is going to be long!

The Best Way To Invest $10000

Remember that investment success goes hand in hand with a long time horizon, consistency and high diversification.

This reminds me of the salsa vs. guacamole every time I order my favorite movie night taco. I can never decide so I go for both!

All jokes aside, good financial health requires savings and investment. But without the former, you can’t achieve the latter: saving money is the cornerstone of personal finance.

Think of it this way: The only way you can prioritize investing over paying off your credit card debt is if you can consistently earn a higher return than the interest rate you’re paying. In August, that’s a pretty tough goal if you ask me. If you’re a startup, not even Wall Street hedge funds can deliver that kind of performance consistently. believe me.

Can Stocks Make You Rich? Exploring Investment Options In Stock Markets

Cars break down, plumbing breaks down, people lose their jobs. Everyone needs a little cash for those unexpected rainy days. An emergency fund is just that, an emergency fund. In general, the size of your emergency fund has a lot to do with the volatility of your income. The higher the volatility, the bigger the fund. A good rule of thumb is to have at least 3 months of your expenses on hand.

Maybe buy a new car, move to a new country, or send your child to college. If you know you need money, don’t invest it. You might consider using a high-yield savings account. It won’t do much for inflation, but something is better than nothing…I guess.

If you’d like me to share some tips on debt settlement strategies (that work) and additional emergency fund content, leave a comment below or contact me on Linkedin. I have written a lot about these topics on my blog and I would like to share them with you.

The main takeaway: You should sit on a “fat” emergency fund (a high interest rate) and be debt-free before considering investing.

Prob Posted Already But Invest Long. Dont Try To Time The Market. Unless You’re A Day Trading Pro.

If you’re looking for a quick answer, yes, £10,000 can be enough to invest… to get you started!

I came across a very interesting survey by M. Boyle and S. Barber for Finder UK. According to their findings, by 2023 the average person in the UK will have £17,773 in savings, with half of the population having £1,000 or less and a quarter (23%) of Britons having no savings.

An example can give us some pointers: Let’s say you invested £10,000 in the S&P 500 on the first day of January 2001. 20 years later, at the end of 2022, you decide to look at your portfolio and find that £10,000 is now now. worth £44,792.

If you’re wondering what the S&P 500 is, it’s an “index” that tracks the performance of the 500 largest publicly traded companies in the United States. If “index” doesn’t ring a bell, it’s a more sophisticated way of describing a “big basket” that contains the 500 largest companies in the United States. Investing in this basket is, in a sense, like investing in the US economy as a whole.

Where To Buy Physical Gold On A Budget? < $10k

Do not forget rule no. 1 of investing: Past performance does not indicate future returns. Just because the SP500 has worked well for the past 20 years doesn’t guarantee it will for the next 20 years.

Although £10,000 can be a great opportunity for your investment portfolio, you need to understand that investing successfully is not a one-time process.

Think of it like a garden – don’t just go there, plant a seed and expect a lovely garden full of flowers the next morning.

If you’re looking for a flower garden, you’ll need to plant the seeds regularly, feed them as they grow, and be patient as they take time to bloom.

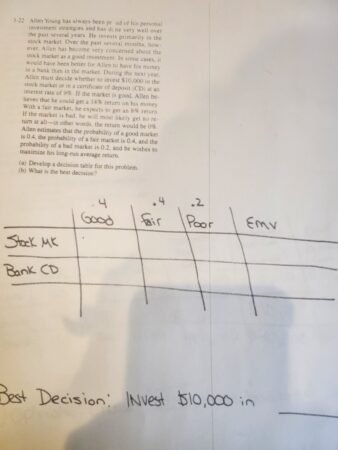

Solved Best Decision: Invest $10,000 in

If you want to be a successful investor, you need time, regular capital and proper risk management.

Plus, passive investing can be easier than gardening, requiring less monitoring, repairs and adjustments than you might think.

Key: £10,000 can be a great start! But success requires great success: a long period of time, a consistent investment of capital and adjusting the level of risk when necessary. These factors will be key to determining whether your investment pays dividends in the future, no pun intended

If you’re still with me, I assume you have an emergency fund ready to go and you’ve successfully gotten rid of any high-interest debt.

Investment: What Are The Best Investment Avenues For A Millennial To Invest Rs 10,000 Per Month?

Before entering the stock market risking possible careless mistakes, we need to develop an investment strategy.

This is an essential first step for every investor as it acts as a road map, marking the milestones and providing the necessary guidance for this long journey ahead.

Not having an investment strategy is like trying to get out of a maze, blindfolded and without a map; I mean, you can get lucky and get away, but why risk it?

Key Takeaway: Lay the groundwork for your investment journey by formulating a well-defined strategy that includes a time frame, a clear risk profile, specific objectives, tax considerations and a well-balanced portfolio.

July 2022: Market Timing Does Not Work

It’s time to decide your time horizon. In other words, how long are you willing to invest the £10,000?

Time frame is a very important factor as it determines the level of risk you are comfortable with and therefore the most suitable investment vehicle to build your portfolio.

Ask yourself this question: How would you feel if they closed that £10,000? Do you need it?

Although you can sell whenever you want, investing means locking up capital for a certain period of time.

Survey: Best Ways To Invest $10,000 In 2022, According To Experts

That means you don’t have to rely on that money for future expenses or unexpected financial shocks that may occur—you have an emergency fund for that, remember?

What should i do? A mental model that has always worked for me is to treat invested money as lost. He’s not there… poof… he’s gone! Then one day I feel like my investment is a deposit of money that comes with a huge bonus (called return on investment).

Key Point: It is advisable to look at longer time horizons when deciding the timing of your investments.

:max_bytes(150000):strip_icc()/dotdash_INV_final-Growth-Of-10K_2021-01-90f5ef3731f54bc491f1fd33b3085171.jpg?strip=all)

Complete elimination of risk is more of an illusion than a reality; even supposedly safe investments like government bonds carry some risk.

Nri Investment Plans In India 2024

The right question to ask is, am I comfortable tolerating this level of risk for the potential return on this investment?

Risk expresses the possibility that the result of an investment will be different from what we expect. The greater the potential benefits, the greater the risk.

I asked the famous founder of Vanguard, John C. Bogle, and he replied, “When it comes to returns, time is your friend.”

The shorter the time frame, the more vulnerable your investment will be to sudden market ups and downs. The longer the time, the more the daily volatility has some impact. Plus, you have more time to recover from the recession.

What Is The Ideal Savings According To Age Bracket?

Imagine investing before the Great Financial Crisis and being forced to sell the following year. The value of your investment capital may have decreased.

You deliberately decide to sacrifice the short-term joy of spending your money now for a greater long-term reward. This concept is called delayed gratification and it turns out to be another great investment mental model.

The type of reward you expect from your investments is based solely on you, your aspirations and your unique circumstances.

Are you thinking of buying a house? Maybe saving for retirement? Funding your child’s school fees? Are you trying to create an additional stream of passive income? Or will you accumulate wealth over the long term?

Tips For Choosing The Right Investment Property

Key Point: Whatever your goal, make sure you’re clear before you invest. A well-defined goal acts as a milestone, keeps you on track and allows you to visualize the future as you wish.

Benjamin Franklin once said that there are only two certain things in life: death and taxes. Apparently old Benji didn’t know about UK ISAs.

ISAs are for individual savings accounts and investments made through them are exempt from interest and capital gains tax.

What's the best way to invest 10000, the best way to invest 10000, what's the best way to invest $10000, whats the best way to invest 10000, best way to invest $10000, what is the best way to invest in silver, what is the best way to invest in gold, the best way to invest 10000 dollars, best way to invest 10000, what is the best way to invest your money, the best way to invest $10000, what is the best way to invest 10000 dollars