When To Start Investing In Real Estate – What is the most important thing to look for in real estate? While location is always an important consideration, there are many other factors that determine whether an investment is right for you. If you are planning to invest in the real estate market.

The adage “location, location, location” is still king and the most important factor in real estate investing. Proximity to amenities, green space, scenic views and neighborhood are key value factors. Proximity to the residential property market, warehouses, transport hubs, highways and tax-exempt areas play a significant role in the value of commercial properties.

When To Start Investing In Real Estate

Key to property location considerations is a medium to long-term view of how the area is expected to grow over the investment period. For example, today’s peaceful lot behind an apartment building may one day become a hub of noise and decrease in value. Carefully check the ownership and intended use of the direct areas you plan to invest in.

Private Equity Real Estate Investing: Where To Start

One way to gather information about the possibilities around the property you are considering is to contact the city or other public authority responsible for urban planning. This will allow you to have a long-term space plan and determine how well your plan will or will not fit the property.

Property value is important for financing during the purchase, listing price, investment analysis, insurance and taxes, all of which depend on the value of the property.

Given the low flow and high value of real estate investments, lack of clarity of purpose can lead to unintended consequences, such as financial hardship, especially if the investment is mortgaged.

Cash flow shows how much money is left after expenses. Positive cash flow is the key to good returns on investment properties.

How To Invest In Real Estate With No Money

Loans are easy but can be expensive. You are using your future income for many years at today’s interest rates. Learn how to manage these types of loans and avoid subprime loans, or what they call leveraged loans. Even real estate professionals face high leverage in bad market conditions, and high debt and lack of liquidity can cripple real estate projects.

New construction typically offers attractive pricing, customization options, and modern amenities. Risks include delays, cost overruns and unfamiliarity with the newly developed region.

A few important things to consider when deciding whether to build a new or existing property:

Managing physical assets over the long term is not for everyone. There are options that allow you to invest indirectly in the real estate industry.

Why You Should Start Investing In Real Estate Immediately

Your credit score affects your mortgage eligibility, which affects your lender’s offer. If you have good credit, you may be able to get better terms – which can add up to big savings over time.

Discrimination in mortgage lending is illegal. If you believe you have been discriminated against based on your race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take. One such step is to file a report with the Consumer Financial Protection Bureau or the US Department of Housing and Urban Development (HUD).

A score above 800 is considered excellent and will help you qualify for a better mortgage. If necessary, work to improve your credit score:

As with any investment, it’s best to buy low and sell high. The real estate market is changing, and you need to stay on top of the trends. It is also important to pay attention to the mortgage interest rate so that you can reduce your capital expenditure.

Real Estate Investing: How To Start Investing In Real Estate

Real estate can help diversify your investments. In general, real estate has a low correlation to other major asset classes – so when stocks go down, real estate usually goes up. Investing in real estate offers steady cash flow, substantial appreciation, tax benefits and competitive risk-adjusted returns, making it a good investment.

Of course, as with any investment, before investing in real estate, whether you choose physical property, real estate, or anything else, there are certain factors to consider that are detailed here.

The recommendations in this table come from affiliates who have received compensation from them. This offset may affect how and where the menu appears. Excludes all offers on the market. How to Invest in Real Estate: Dec 13, 2023 Real Estate Trading Real Estate Trading Real Estate Trading 10 Best Ways to Collect Real Estate Investing Strategies

Starting the real estate journey can seem daunting to newcomers, but with the right knowledge, anyone can tap into its potential. Real Estate Skills is dedicated to clarifying everything beginners need to know about real estate investing and organizing experienced and new investors alike. The path to success.

The Basics Of Real Estate

Real estate is one of the most researched investment avenues. Joined by all experienced real estate investors – proven ability to create wealth, provide stability and add significant wealth to your investment. Business tycoons and young investors often flock to real estate, which is a real part of the world, not only with the promise of substantial returns, but also with the lure of acquiring substantial assets.

Investing in real estate is not just about buying land or property. It’s about understanding market dynamics, using financial tools and turning brick-and-mortar assets into practical strategies. . Whether it’s the art of demolishing a property, becoming a landlord or strategically parking in valuable areas, the changing real estate market offers a variety of opportunities.

Before we begin our guide on how to invest in real estate, we invite you to watch our video on how to get into real estate with no money down! Alex Martinez, Host and CEO of Real Estate Skills, offers a complete guide to investing in real estate without owning your own new property!

Real estate investing revolves around buying, owning, managing, and ultimately selling or leasing a property.

The Book On Investing In Real Estate With No (and Low) Money Down: Creative Strategies For Investing In Real Estate Using Other People’s Money By Brandon Turner

Whether you actively participate in property development, make improvements to increase property value, or participate passively, you are part of the wider world of real estate developers and investors. This multifaceted effort goes beyond just buying and selling. This strategy is about understanding market dynamics and taking advantage of investment opportunities.

Often considered the foundation of an investment portfolio, real estate is more than just buying and selling real estate, it’s an art and a science.

Although it has significant profit potential, it is important to understand its complexities in order to truly reap its benefits. In this section, we’ll discuss what real estate investing actually entails, the many benefits it offers, the risks involved, and how to mitigate those risks.

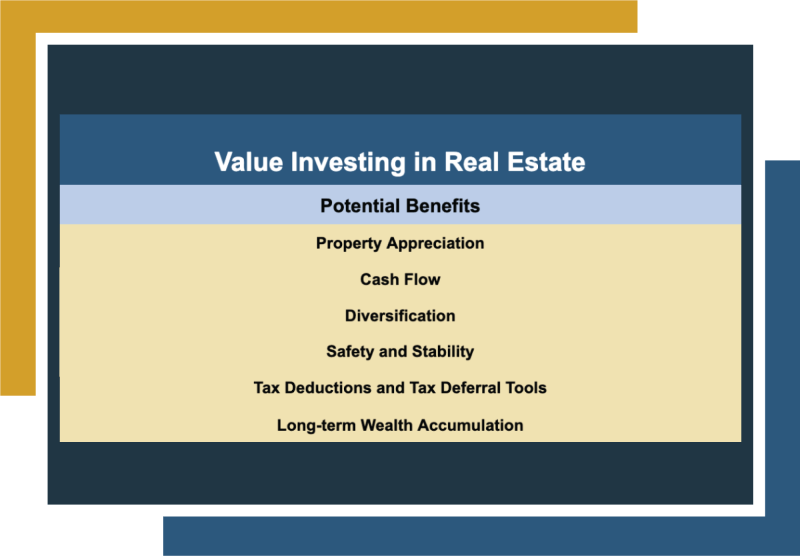

Delving into the world of real estate investing offers a variety of benefits, making it an attractive option for those looking to diversify their investment portfolio or seek long-term financial security. Let’s break down some of the main benefits:

The Ultimate Guide To Real Estate Investing: Everything You Need To Know As A Beginner

With these advantages, it is clear that real estate is a strong pillar in the investment landscape, guaranteeing immediate and long-term returns for the savvy investor.

While there’s no denying the appeal of real estate investing, as with any investment, it’s important to be aware of real estate’s downsides and potential pitfalls.

Understanding these pitfalls and having strategies to combat them can lead to safe and successful investment decisions. Below is a brief summary of the risks and how to reduce them:

Now that you have an overview of the opportunities and risks in this industry, we invite you to start looking at the different properties you can invest in – each with its own unique return potential.

Real Estate: Short Term Real Estate Investments: A Lucrative Opportunity

From family rental homes to industrial units, from retail centers to dynamic mixed-use properties, real estate encompasses a wide range of assets.

Additionally, for those who prefer a more hands-on approach, diving into real estate investment trusts (REITs) is an opportunity to offer a piece of property without the hassle of direct ownership.

Now, let’s explore 10 different types of real estate investments to provide you with the knowledge to determine which one is right for your financial goals and investment strategy:

Real estate brokerage is a unique strategy that relies on the rapid turnover of assets. In fact, investors typically find properties at a discount and below market value and buy them under contract. However, they sell these properties instead of buying them. Right to purchase to an interested buyer.

How To Invest In Real Estate 2024

This method is recognized as one of the fastest ways to make a profit in the real estate world, with some wholesale contracts being changed within hours.

Imagine finding a homeowner who urgently needs to sell their property, perhaps due to financial constraints such as foreclosure or other debt. Often, these properties are distressed, which gives investors the opportunity to negotiate lower prices.

Upon arrival

Start investing in property, investing where to start, best way to start investing in real estate, stocks to start investing in, start investing in stocks, how to start investing in real estate, ways to start investing, start investing in real estate, ways to start investing in real estate, investing in start ups, when to start real estate investing, where to start in real estate investing