Where To Find Financial Statements For Public Companies – Financial statements refer to the official documents that businesses, from corporations to sole proprietorships, need to keep and show a company’s financial position and business performance over a period of time. These statements are carefully reviewed and updated by service providers, government agencies and regulatory agencies depending on the rules and regulations governing the nature of the business. For example, if you are self-employed, the regulator can only check your tax returns. But if your business is an independent corporation (such as a limited liability corporation or company), keeping and auditing financial statements is essential.

The income statement is an important financial statement document in determining the financial position of a company. It contains information about a business’s income, expenses, and net profit in two forms: single-level and multi-level income statements.

Where To Find Financial Statements For Public Companies

Here’s a real-life example of Amazon’s earnings report from 2015 to December 31, 2017.

Public Or Private?

These separate subheadings can be divided into different categories. For example, expenses include employee expenses, marketing expenses, administrative expenses, financial expenses, etc.

However, it is important to understand that income statements primarily talk about a company’s performance during a reporting period (usually an accounting year). It does not provide information about the company’s performance over the years.

Balance Sheet According to Investopedia, a balance sheet is “a statement that provides a timely overview of a company’s assets, liabilities, and stockholders’ equity. The date at the top of the balance sheet tells us when the snapshot was taken, which is usually the end of the fiscal year.”

Cash and cash equivalents: Most liquid assets can be converted into cash, including treasury bills and certificates of deposit.

Analysis Of The Influence Of Timely Submission Of Financial Statements Of Transportation Companies Listed On The Indonesia Stock Exchange 2017 2021

Stockholders’ equity can best be defined as the percentage of shareholder ownership of a company, calculated as total assets minus liabilities. If you want to read more, we have an article that describes the property in detail.

A cash flow statement plays an important role in explaining how your business used its cash reserves during the financial year. Cash costs and expenses are generally divided into three categories.

Operating activity refers to cash expenditure/income incurred in the normal course of business operations. This heading applies only to business activities and does not include inflows/outflows in the form of borrowings, purchases of fixed assets etc. Instead, consider the following.

Basically, net cash flow from operating activities can be determined in two ways: direct and indirect. More information on cash flow comparisons and reports, as well as tips for optimizing your cash flow, can be found in our complete cash flow guide here.

Pdf) Analysis Of Other Comprehensive Income In Relation To The Statement Of Financial Position At Several Companies That Go Public

Cash receipts/expenditures incurred in connection with the provision of capital for the growth, development and day-to-day running of the business are classified as financing activities. It includes:

Financial reporting is a necessary and central part of an enterprise’s accounting process. With cloud tools to automate your financial reporting and prevent compliance issues without creating too much hassle for business owners, it’s made much easier. With an all-in-one business plan, you’re sure to cover all your bases. Be sure to subscribe to our newsletter for more informative blogs and articles!

The Complete Guide to Cash Flow and Cash Flow Statements [++ Template] Have you ever wondered why cash flow management is so important to small business owners? In this article, we will explain the uses of cash flow statement and more. We’ve even prepared free Excel templates for you! Adi Ho blog

Understanding the Income Statement and How to Prepare It Takes a little research and some financial knowledge to know what an income statement is. As for the income statement, remember that it is a pure form of profit and loss statement[/blog/guide-income-statement-small-businesses/]. Sometimes the word … Priyanka Tiku Tripathi Blog

Revised Chapter 2 Financial Statements And Corporate Finance

A Guide to Balance Sheet Concepts The balance sheet (also known as the statement of financial position) is one of the 3 major financial statements. It helps in revealing the overall financial position of the company along with income statement and cash flow statement. Kevin blog

Great! Next, complete the payment to get full access to the blog. You are successfully logged in. You have successfully registered your blog! Your account is fully activated and you can now access all the content Success! Your billing information has been updated Your billing information has not been updated Every investor, company leader, and aspiring leader should understand how to read an income statement (profit, loss, or P&L). An income statement is a window into a company’s performance over a specific period of time by reporting its revenues and expenses.

All three reports are prepared in accordance with GAAP (Generally Accepted Accounting Principles) for US companies or international versions for companies located abroad. These are the accounting rules for how everything should be recorded, but they are constantly being updated and changed.

Below is a quick cheat sheet for the main income statement lines. If you want more details and explanations, keep reading…

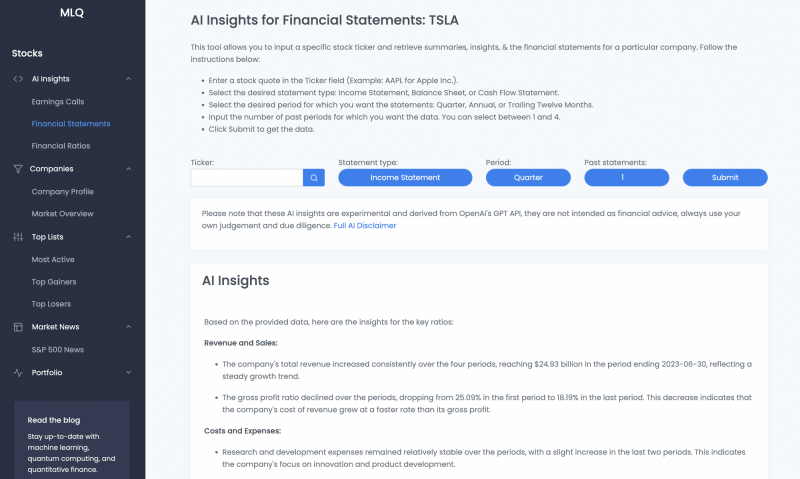

Retrieving Financial Statements (how To)

If professional services revenue is intangible, many companies will show only a single line item called “Revenue” on their financial statements. For internal management reporting, all major revenue categories should be broken down to consider each type of revenue separately.

Depending on who you talk to, the word “revenue” can have a dozen different meanings for SaaS companies. Check out the tweets below for the differences between these acronyms.

@ Most people don’t understand the difference between the term SaaS “revenue”. There are many acronyms… ARR, CARR, ACV, TCV, GAAP Revenue, RPO, etc. Here’s what you need to know👇🧵 13:16 ∙ September 21, 2022 459 Likes 59 Retweets

When we say “income” in an income statement, we mean GAAP income. Other commonly used abbreviations for “income” such as ARR, CARR, ACV, etc. are annualized amounts. For GAAP revenue, this amount should be allocated over the service delivery period (subscription or service life).

How To Read Income Statements

There are two basic SaaS revenue recognition models (and varying degrees of hybrid models between them):

Below are typical rules for revenue recognition, but each company’s specific facts may affect how revenue is recognized. Because of its complexity, thousands of pages have been written on this topic!

Solution: Revenue is recognized only when consumed, consumption-based pricing revenue is higher than traditional SaaS models.

“Also, like I said, Q4 is the season when we’re with people over the seasonal holidays and remember that about 70 percent of our revenue is human-to-system interaction. Scheduled work. So that’s going to have an impact.” –

Lesson: Public Company Reporting Topics & Eps Overview And Objectives

“We recognize revenue based on user usage of the platform, and usage is closely related to end-user activity on the app, which is influenced by macroeconomic factors.” – Michael Gordon (CFO, MongoDB)

This applies to traditional SaaS pricing models. It can be several seats or licenses for the duration of the contract – it doesn’t matter how much the software is used.

Example: ABC Company entered into a $120,000 contract on January 1, 2023, to purchase 5 reserved seats over the next 12 months.

Solution: Revenue is recognized over the period of the order. This is true regardless of usage level, as it is available throughout the subscription period.

Financial Statements: Decoding Financial Statements Of Public Companies

This revenue is always separate from the subscription revenue and does not affect the total profit. Most investors view Professional Services Earnings as a negative or neutral valuation of a company for the following reasons:

Many people just say “COGS” means cost of goods sold, but in pure SaaS there is no such thing as “goods”, so when reporting financial statements, this line is simply written as “cost of revenue”.

@ Should Customer Success Live in COGS or S&M? It is time to resolve this debate one by one and create rapport between companies. 🧵👇 13:39 ∙ September 7, 2022 43 likes 8 retweets

Investors should have a better understanding of what is included/excluded from GNP to make an informed decision when compared to other companies.

Notice To All Listed Companies/securities Extension For Filing Of Financial Statements (update #1)

Gross profit tells you how much profit (% of revenue) you have after subtracting PRICE from revenue. In the formula below, we can see gross profit as a percentage of revenue. Looking at gross margin as a percentage of revenue is often more useful because it can be compared to benchmarks and other companies.

Because the valuation of a SaaS company is highly correlated with gross profit, CPI is a more defensible set of financial costs.

As mentioned earlier, there are reasons why investors view professional services returns as poor or neutral when making investment decisions.

Financial statements for private companies, financial statements for companies, where to find financial statements for companies, how to find financial statements for private companies, where to find financial statements, how to find financial statements for public companies, companies with public financial statements, companies financial statements free, financial statements for construction companies, where to find financial statements of public companies, public financial statements for companies, manufacturing companies financial statements