Wire Transfer From Us To Philippines – Wise, formerly Transferwise, is a new type of financial services company founded in 2011 by two Estonian friends who realized they were paying too much for international money transfers. Since then, they have made strides in how people move money across borders and have received support from investors who believe in their ideas, such as PayPal co-founder Peter Thiel and Virgin founder Richard Branson.

More than a million people around the world use this knowledge and send $1.5 million a month. By doing this, they save $2 million a day because Wise’s technology allows them to transfer money overseas using real exchange rates and a small upfront fee. It’s cheaper to use other providers because transfers are actually made through local bank accounts, meaning the money doesn’t actually cross borders.

Wire Transfer From Us To Philippines

Because of this, more and more people are learning how to transfer money using a smart card, and in this guide, we will show you how to do it.

Sending Money Via Domestic Or Foreign Transfer Via Metrobank Business Online Solutions (mbos)

PayPal transfers incur a minimum 4.5% fee when transferring money cross-border. Maspay, their cheapest method, charges a 2% fee and then adds an additional 2.5% currency transfer fee.

Yes, that’s a total of 4.5% that you will be charged in the form of transfer fees and currency transfer fees, which you will most likely find out about after you make the transfer.

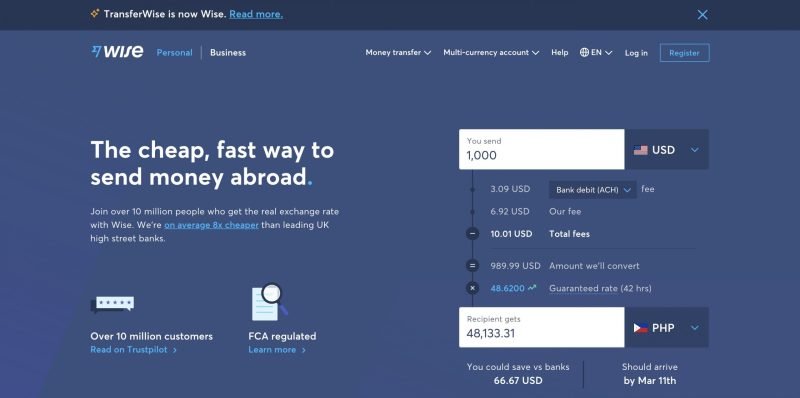

PayPal charges you $45 if you send $1,000 overseas. Using Wise, you’ll only be charged a maximum of 1% on transfers, and there are no hidden currency exchange fees, meaning the total cost is $10. This is completely different!

Every bank and almost every money transfer company like Western Union makes its money from hidden currency exchange fees. Wise has no hidden fees and they announce all their fees up front:

How To Send Money To Russia In 2024 (my Personal Experience)

Learn more about hidden fees for currency exchange. If you don’t understand what I mean by “hidden currency conversion”, check out the explanation in this article.

It’s really that simple! All you have to do is go to their website, set up your translation and create an account. You can start here using the calculator below.

They will then confirm the transfer amount, show you the correct exchange rate and add your details:

The fastest option is to pay by debit or credit card. The money will reach you almost instantly and they can immediately start converting it for you. However, credit cards incur additional fees and this method can only be used for amounts up to $1,000.

Send Money To The Philippines From Usa

You can also pay by direct debit, which allows you to link your online banking directly to Knowledge (formerly Transfer Wise). This method does not require any additional costs and is very convenient. Your information will be verified using your online banking username and password, and in some cases micro-deposits will be sent to your account. With Direct Debit, your money will arrive within 1-3 business days and can be used to send up to $10,000.

If you want to send more than $10,000, you need to make a local bank transfer. The downside is that your bank will likely charge you an extra fee when you transfer money from their account to Wise, but it’s very quick; Your money will reach your attention within a few business hours. By sending money via bank transfer, you can send up to $1,000,000 per month. broadcast.

Whether you choose Bank, PayPal or PayPal Advanced, there are different options available. But if you’re looking for a reliable, reasonably priced provider that will save you money, we recommend the smart TransferWise up front.

Robbie Rawson is the co-founder of Time Doctor, software that helps you increase productivity and keep track of what your team is working on. Use Zoom to travel safely and seamlessly to the Philippines, even if you’re working remotely. Distribution options: You control how your money gets to its destination.

Cross Border Payment: How To Use Wire Transfer Using Wells Fargo Bank

Your recipient in the Philippines does not need a Zoom account. You can still send money to him.

Get real-time exchange rates and secure transfers with Xoom. Select the recipient’s bank and enter their account details. Your money is usually delivered to the bank within a few hours.

Using Zoom, your loved ones can usually raise money in minutes. Simply provide your information and select the appropriate pickup location.

Get direct access to your family’s doorstep with Xoom. Add a name and address and money will usually be sent within 6 hours or less in Metro Manila, 3 hours and 1-2 days in most provinces.

Send Money To Nigeria From The Us

From your account to their apps, usually in minutes with Xoom. Provide recipient information and make a convenient transfer directly to the Philippines.

International personal payments and purchases are subject to cross-border payments. They are paid by either the sender or the recipient, not both. The sender of the payment usually decides who pays the fee. Cross-border fees apply because payments in multiple currencies incur additional costs. You can read more on our Payments page.

We use 128-bit data encryption for all transactions, ensuring a secure and private connection. In addition, we secure your information on servers that are physically and electronically secure and regularly review our security measures. Learn more about security

The time it takes to transfer money to the Philippines depends on the selected delivery method. Cash withdrawals and transfers to mobile wallets are usually completed within minutes. Money for bank deposits usually arrives within a few hours at certain banks, while others can receive door-to-door delivery in Metro Manila. recipients within 6 hours or less if sent before 3 pm. Typically delivery to most provinces takes 1-2 days.

Complete Philippine Banks Swift Code Official

Yes, you can send money online to all major banks in the Philippines. These include, but are not limited to, Banco de Oro (BDA), Bank of the Philippine Islands (BPE) and Philippine National Bank.

Easily and securely send and manage your transactions, all in one place. Download the app to your phone or register for free online.

By clicking “Send Link” you agree to receive a text message with a link to the application. Data charges may apply.

The transfer is under review and may be delayed or stopped if problems are discovered. The speed of provision of money transfer services depends on a number of factors, including:

Money Exchange Philippines

Subject to improvements in funding availability, risk and compliance screening, and system accessibility. Daily offers and limits apply. Services vary by country. Fees and limits apply.

Speed of service is subject to availability of funds, Xoom’s proprietary verification system, system availability, and sending restrictions. May not be available for all transactions. You do not need to open a US bank account to transfer money securely outside the US. Today we will teach you how to do this with the help of local banks and startups that help Filipinos transfer money from the US to the Philippines. .

When preparing to transfer money from the US to the Philippines or finding an efficient international payment method in your country, understanding exchange rates is critical. The optimal exchange rate can greatly impact the amount of PHP you receive for your USD. To get the most out of your bank transfer, view the current exchange rate between USD and PHP. Banks often offer different exchange rates and may include hidden fees. Therefore, comparing prices is an important step before sending money abroad. Be sure to check if the exchange rate is competitive, and don’t be shy about looking for a platform that specializes in money transfers. Some may offer better exchange rates than traditional banks, resulting in significant savings.

Transferring money internationally can seem complicated due to fluctuating exchange rates. But by taking the time to compare, you can make your money transfer cost-effective and secure. Remember, whether you are sending small or large amounts, the cumulative effect of a favorable exchange rate should not be underestimated. Changing your bank transfer at a time when the exchange rate is higher can provide better value for money.

How To Track An International Wire Transfer

Lastly, don’t rush into making a decision – take the time to research and transfer money when you’re sure you’re getting the best price to maximize the value of your hard-earned money. With the right approach, this can be done without problems.

To the Philippines without having to worry about losing out on a favorable exchange rate. Be smart, compare prices and watch your PHP grow while managing bank transfers efficiently from home.

If you want to send money to the Philippines, you need a savings transfer strategy to ensure that transfer fees don’t eat up your hard-earned money. By carefully comparing exchange rates and avoiding the risk of hidden fees, you can get the most out of every dollar you send.

Keep in mind that bank accounts in the Philippines may have different policies, so it’s important to understand your bank’s approach to international transfers. Choose service providers who offer competitive rates and beware of those who do not disclose clear information.

How To Send Wire Transfers With Mobile Banking

Wire transfer from us to canada, wire transfer from philippines to canada, wire transfer us to philippines, wire transfer from philippines to usa, wire transfer canada to us, wire transfer from philippines to us bank, wire transfer from us to india, wire transfer to philippines, wire transfer from us to uk, money transfer from us to philippines, wire transfer from us, wire transfer to us